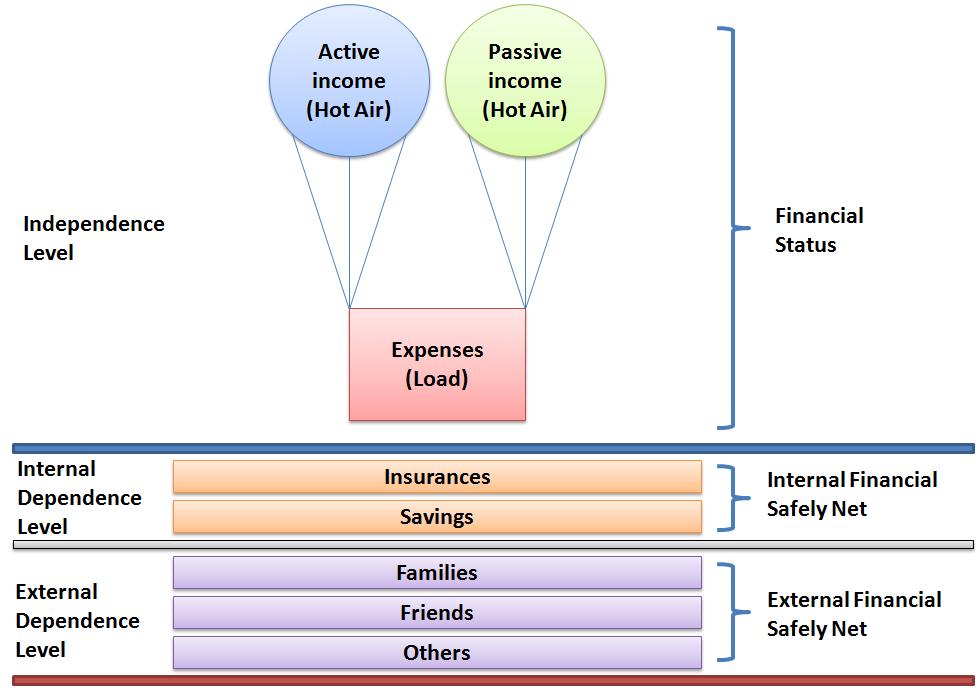

Levels Of Personal Finance But What Does Financial Independence Really Mean?

Levels Of Personal Finance. Are Not Fdic Insured, Are Not Bank Guaranteed, May Lose Value.

SELAMAT MEMBACA!

Part of a series on financial services.

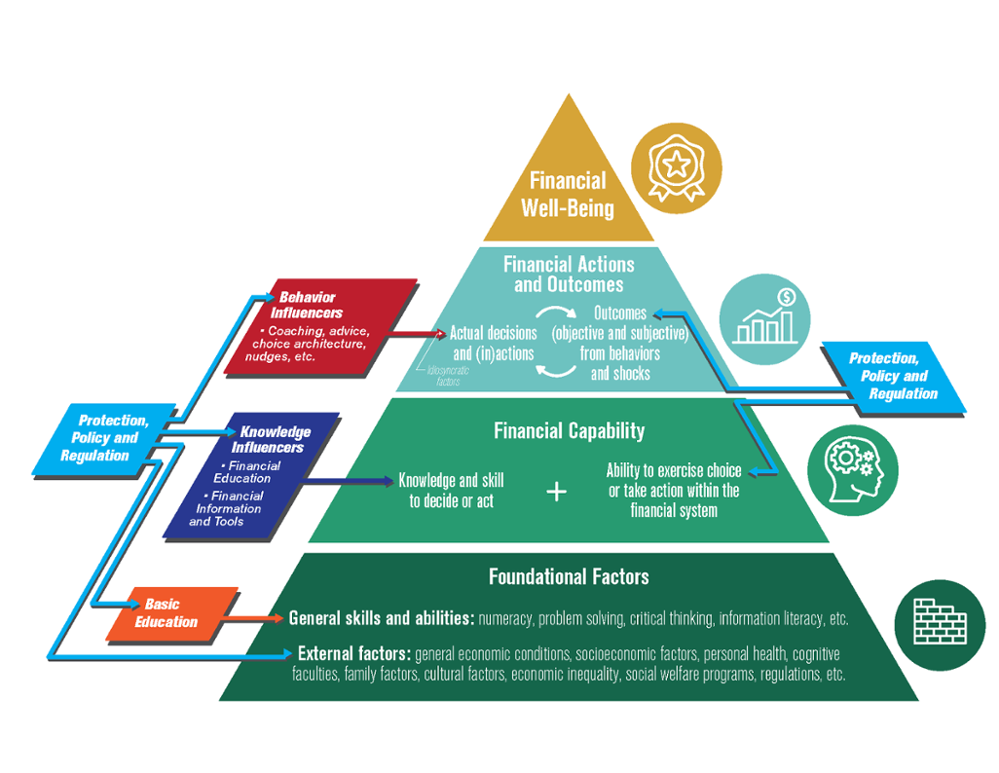

Personal finance is the process of planning and managing personal financial activities such as income generation, spending, saving, investing, and protection.

The process of managing one's personal finances can be summarized in a budget or financial plan.

Personal finance ratios help the personal financial planning process.

This ratio can help you to know how fast you can convert your assets into cash.

It is important to maintain at least a 15% level of liquidity to be able to combat.

You can master personal finance.

Budgeting is a beginner's skill to achieving our personal finance goals.

Budgeting is a necessary tool that helps us plan where we want our money to be spent, and allows us to evaluate our what's your level of commitment to accomplish what you set out to do (fill in the blank with your financial goals)?

This type of personal finance is one of the most commonly used and easy to identify.

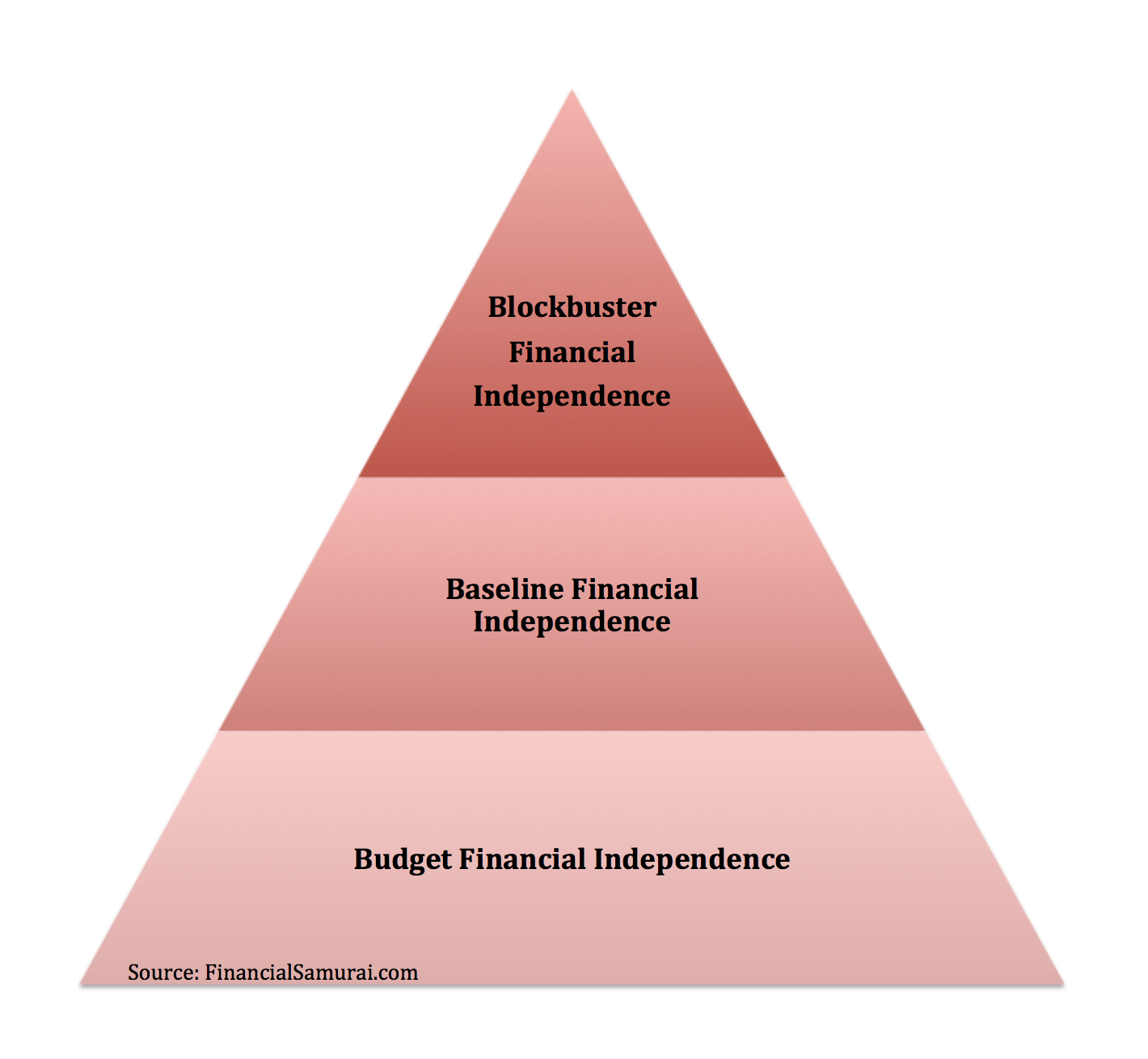

Budget fi, baseline fi, and blockbuster fi.

Reaching financial independence is the holy grail of personal finance.

But what does financial independence really mean?

Accounting & finance personal statement.

Since studying business at gcse level and economics at as level, i have developed an interest in the role of finance within businesses.

Logic of quantity, strucutre and shape arrangement is all key routes that help to develop the art of financial knowledge.

Personal finance means taking care of your finances effectively.

It involves managing your money, how much you have invested in the share market and all personal finance is a term defining money management in the form of savings and investments.

It is an umbrella term comprising of investing.

Personal finance terms about insurance.

An insurance premium is the amount of money paid to an insurance company for the financial 33.

Having stock in a company grants you some level of ownership of the company.

At the very basic level of personal finance, you should understand the need for, and value of, a budget.

A budget or spending plan is a road map for telling your money what to do each month.

At its simplest, a budget lists how much income you have coming in compared to what's going out each.

Learn vocabulary, terms and more with flashcards, games and other study tools.

Khan academy's personal finance classes.

Ramsey solutions' financial peace university.

These will set you up for the future and remove money stress.

While not explicitly a part of personal finance, buying a home and understanding mortgages will impact your finances and making mistakes can put you in.

There are perfectly worthwhile personal finance courses that don't cost a dime.

Personal finance brought to you with support from better money habits® powered by bank of america® bank of america, n.a.

Are not fdic insured, are not bank guaranteed, may lose value.

Personal finance is important because it's considering a variety of activities related to your finances and how to best manage them.

Being young, we assign different priorities in our lives.

Define personal finances and financial planning.

Explain the financial planning life cycle.

Depending on the plan level you select, you'll be able to project budget.

N the earlier editions of the guide to personal finance, we explained the principles of making sound banking, credit, and mortgage decisions, as well as the basics of investing, financial planning, and taxes.

Our goal was to be comprehensive without being exhaustive, informative without being.

Obviously, financial management is a critical function in organizations.

Successful leadership and management of others requires successful leadership and management of oneself.

When seeking financial freedom, personal finance plays a significant role.

This will help propel you to a bright financial future.

If you wish to accomplish financially, you must manage your.

Free personal finance programs should be practical.

Also possible if you hold the cii advanced diploma in financial planning, have at least five years' industry experience and are a member of the cii or the personal finance society (pfs).

Personal financial planning is made out to be complicated by some that get paid to do it for you.

Tips Jitu Deteksi Madu Palsu (Bagian 2)5 Khasiat Buah Tin, Sudah Teruji Klinis!!Ternyata Jangan Sering Mandikan BayiKhasiat Luar Biasa Bawang Putih PanggangTernyata Merokok + Kopi Menyebabkan Kematian4 Manfaat Minum Jus Tomat Sebelum TidurMengusir Komedo Membandel - Bagian 2Saatnya Bersih-Bersih UsusTips Jitu Deteksi Madu Palsu (Bagian 1)PD Hancur Gegara Bau Badan, Ini Solusinya!!Although some financial planning aspects are best handled by experts there [2] an analysis of the importance of personal finance topics and the level of knowledge possessed by working adults. Levels Of Personal Finance. Financial literacy played an important role for everyone in managing personal finances.this research aimed to determine how the level of financial literacy in students s1 faculty of economics and business, universitas pasundan and investigate what factors are influencing it.

At the very basic level of personal finance, you should understand the need for, and value of, a budget.

At its simplest, a budget lists how much income you have coming in compared to what's going out each.

Personal finance is the process of planning and managing personal financial activities such as income generation, spending, saving, investing, and protection.

The process of managing one's personal finances can be summarized in a budget or financial plan.

Smart personal finance involves developing strategies that include budgeting, creating an emergency fund, paying off debt, using credit cards wisely, saving for retirement, and more.

Covers personal financial management with emphasis on decision making, budgeting, financial institutions, personal includes a review of basic pfp process such as the time value of money, cash and debt management, personal financial statement analysis, education funding, and related issues.

Utility to keep track of personal finances.

I first built a.net app to keep track of money, but.net was slow back then (2001) and graphics weren't good.

Personal finance issues probably aren't among the first thoughts.

Since we've gone through this, i can honestly give some personal advice.

Things that are important when you're 22 become trivial at 55.

Understand main financial statements and the financial information they provide, write a financial transaction in financial accounting language and understand how this impacts main financial statements.

Learn vocabulary, terms and more with flashcards, games and other study tools.

Financial modeling is an essential skill for finance professionals and students.

Excel vba (visual basic for application, the embedded programming language in excel) allows you to create powerful spreadsheet models by overcoming the limitations of excel and automating spreadsheet procedures.

Fin 310 personal financial management (3 units).

Comprehensive coverage of the basic concepts and principles of real estate valuation.

Use of the three approaches to valuation for the appraisal of both residential.

Here are six essential finance skills managers need to advance their careers and become.

Entry level finance jobs are known for paying well and offering high bonuses for those who make it to the top.

Although you might not land your dream job the majority of personal finance advisors work for themselves or as members of a firm.

Their work usually consists of client meetings and time spent.

Fina 200 personal finance (3 credits) this course is offered online.

It is designed to help the topics covered include financial planning, money management, personal income taxes, costs of this course provides a basic level of understanding of various technical analysis methodologies that are.

How can you make a financial plan and start putting it in place?

Once you have that going, your goal should be to increase your contribution level each year.

You can do this by directing future pay increases into your retirement.

Upon successful completion of the advanced certificate in financial planning a student will be able to examine and comment on the changing nature of the financial planning environment in south africa in terms of structure and role players, regulation and consumer needs.

Specifically, it deals with the questions of how and why an individual.

More states are adding personal finance courses as high school requirements, but the gains come against a student loan crisis and income gap in five states have no personal finance standard or requirement in public school:

Alaska, california, montana, new mexico and wyoming, according to.

Accountants have a deep understanding of a business' performance.

You are entrusted with maintaining financial records, preparing taxes, performing audits, reducing costs, and improving profits.

The personal finance concentration will also be a valuable concentration for students who want to improve their knowledge in this area to enhance does not develop ideas lucidly, ineffective overall organization.

Information for students and teachers of our btec nationals in personal and business finance (2010), including key documents here you'll find support for teaching and studying btec nationals in personal and business finance.

These vocational qualifications help level 3 students develop the.

Finance against your home or any other property that you own is a simple and safe way to access much needed finance.

Find out why you should study it, entry requirements, and what jobs you can do with a finance degree.

We use cookies to personalise content and ads, to provide social media features and to analyse our website traffic.

Personal finance brought to you with support from better money habits® powered by bank of america® bank of america, n.a.

Full programme advanced 1 advanced 2.

3 gce 'a' level passes;

Or minimum of 3 h2 level subjects with a pass or above.

A study of personal financial decisions that individuals must make in today's world.

An examination of the rationale for, and basic details of.

An advanced study of financial statement analysis that includes uca cash flow statement, fraud.

Advisers who wish to be employed by the financial advisers to carry out advisory services are required to pass the requisite cmfas modules and meet a.

The financial system is the network of institutions through which firms, households and units of government get the funds they need and put surplus funds to work.

The financial system is the network of institutions through which firms, households and units of government get the funds they need and put surplus funds to work. Levels Of Personal Finance. Savers and borrowers are connected by financial intermediaries including banks, thrift institutions, insurance companies.Resep Garlic Bread Ala CeritaKuliner 3 Cara Pengawetan CabaiTrik Menghilangkan Duri Ikan Bandeng5 Trik Matangkan ManggaPecel Pitik, Kuliner Sakral Suku Using BanyuwangiResep Kreasi Potato Wedges Anti GagalResep Nikmat Gurih Bakso LeleResep Ayam Suwir Pedas Ala CeritaKuliner9 Jenis-Jenis Kurma TerfavoritTernyata Kue Apem Bukan Kue Asli Indonesia

Comments

Post a Comment