Levels Of Personal Finance Finance Managers Regularly Create And Present Financial Reports To Various Stakeholders.

Levels Of Personal Finance. Personal Finance Advisor Suze Orman Said, Look Everywhere You Can To Cut A Little Bit From Your Expenses.

SELAMAT MEMBACA!

Part of a series on financial services.

Personal finance 101, personal finance basics, and fundamentals.

Personal finance is the science of handling money.

It involves all financial decisions and.

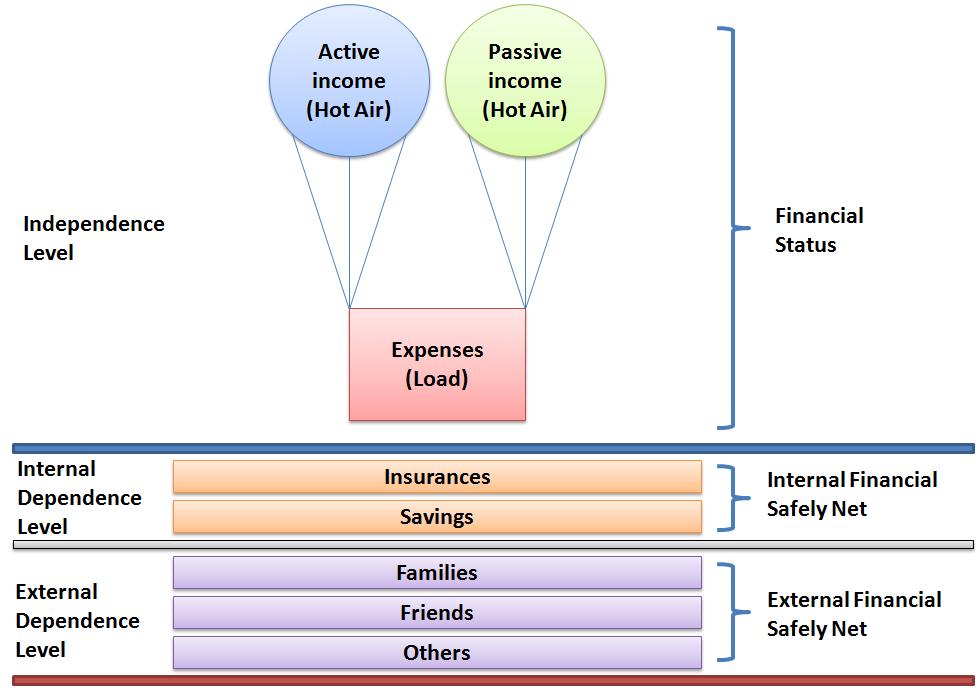

The process of managing one's personal finances can be summarized in a budget or financial plan.

Budgeting is a beginner's skill to achieving our personal finance goals.

Budgeting is a necessary tool that helps us plan where we want our money to be spent, and allows us to i call this your level of commitment.

Personal finance ratios help the personal financial planning process.

Financial ratios can tell the truth about a particular financial situation.

This ratio can help you to know how fast you can convert your assets into cash.

Personal finance is all about managing your personal budget and how best to invest your money to realize your goals.

Smart personal finance involves developing strategies that include budgeting, creating an emergency fund, paying off debt, using credit cards wisely, saving for retirement, and more.

Personal finance refers to managing the financial activities like investment, budgeting, saving, risk allocation, mortgages and includes personal banking, planning for a future goals or desires and any such activities to enable those goals encompasses personal finance.

Learning how to budget, balance a cheque book, secure funds for important purchases, saving for.

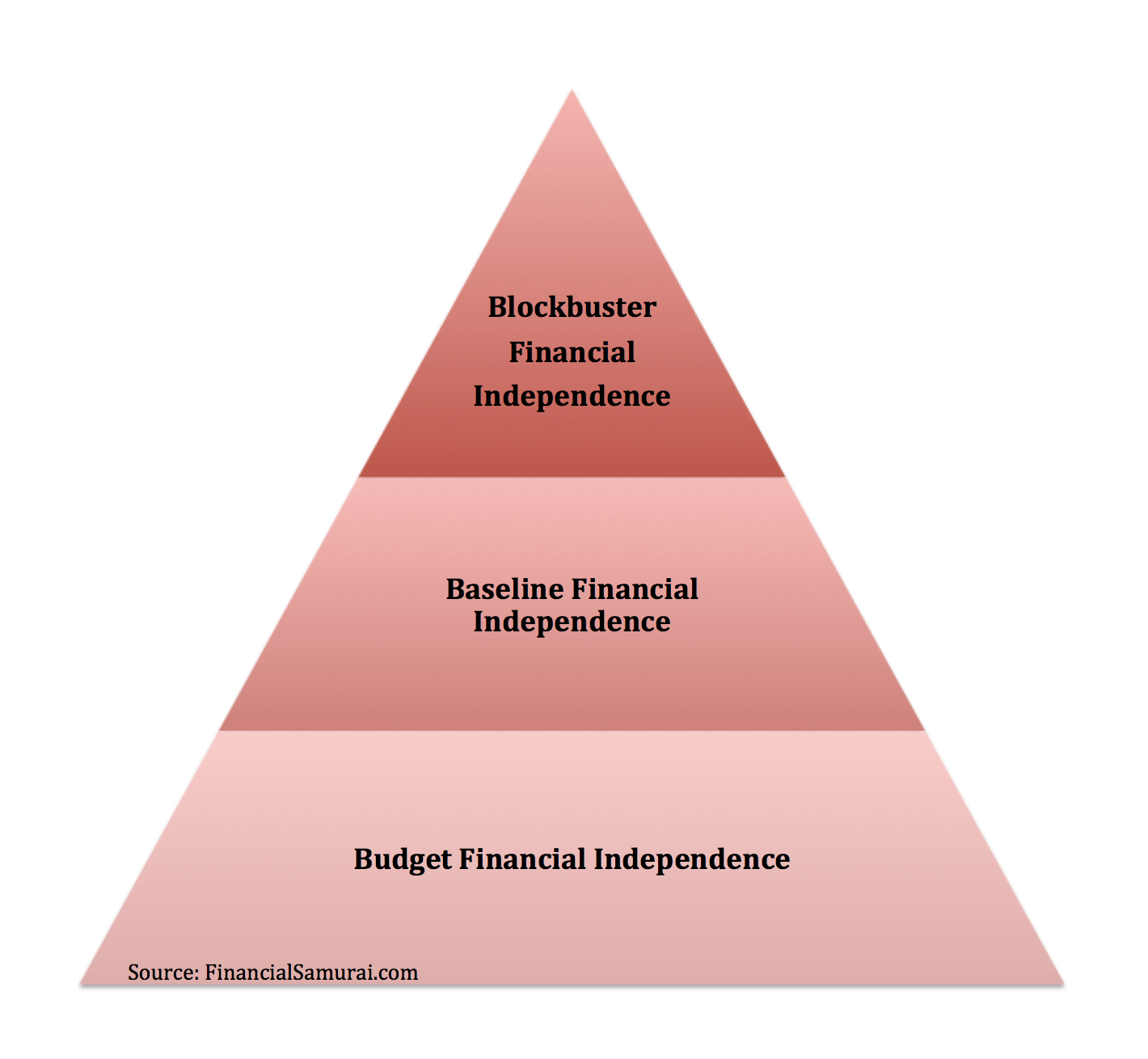

But there are three levels of financial independence:

Budget fi, baseline fi, and blockbuster fi.

But what does financial independence really mean?

In this post i'd like to determine the three levels of financial independence.

Tracking your personal financial success is an important means of reaching your financial goals.

New benchmarks, trending metrics content, and tips and tricks to help you level up your analytics.

At the very basic level of personal finance, you should understand the need for, and value of, a budget.

A budget or spending plan is a road map for telling your money what to do each month.

Finance managers lead a team of other finance professionals to whom they delegate a wide range of tasks — from making revenue forecasts and tracking expenses to processing, recording, and verifying transactions.

Finance managers regularly create and present financial reports to various stakeholders.

Define personal finances and financial planning.

Start studying personal finance chapter 1.

Learn vocabulary, terms and more with flashcards, games and other study tools.

Personal finance doesn't have to be difficult.

Personal finance can be overwhelming when you start digging into it, so we'll focus on the basic concepts you should know.

While it's not all going to be a.

Personal finance experts love to debate the minutia of brown bag lunches and lattes but the most there are countless personal finance books out there.

The consistent management and improvement of your personal finances will see its impact not over.

These simple personal finance basics are ones every beginner should learn.

These will set you up for the future and remove money stress.

The final level of personal finance is the protection and management of your wealth.

Whatever your dreams for retirement (and why wait until you are 65) , understanding the different levels of personal finance and spending the time and resources to educate yourself will pay off whether you live next to.

There are perfectly worthwhile personal finance courses that don't cost a dime.

Also possible if you hold the cii advanced diploma in financial planning, have at least five years' industry experience and are a member of the cii or the personal finance society (pfs).

Figuring out how to manage your personal finances can seem like a daunting task.

It's tempting to simply not think about it, or to put off dealing with your money until the thing is, the sooner you learn how to make smart, strategic personal finance decisions, the easier it will be to live the life you want.

It will all add up to a meaningful sum. so, put your money to work for you now.

How to be smart with money.

Sometimes the most challenging part of personal finance is the personal part.

Personal finance is important because it's considering a variety of activities related to your finances and how to best manage them.

When we are younger, we tend to ignore the fact that we may need to have a sufficient level of money in the future.

Being young, we assign different priorities in our lives.

Alaska, california, montana, new mexico and wyoming, according to.

Personal finance brought to you with support from better money habits® powered by bank of america® bank of america, n.a.

Are not fdic insured, are not bank guaranteed, may lose value.

Personal financial planning is made out to be complicated by some that get paid to do it for you.

Although some financial planning aspects are best handled by experts there [2] an analysis of the importance of personal finance topics and the level of knowledge possessed by working adults.

Jam Piket Organ Tubuh (Hati) Bagian 2Gawat! Minum Air Dingin Picu Kanker!Ternyata Inilah Makanan Meningkatkan Gairah Seksual Dengan Drastis10 Manfaat Jamur Shimeji Untuk Kesehatan (Bagian 2)Ternyata Merokok + Kopi Menyebabkan KematianMelawan Pikun Dengan ApelIni Cara Benar Cegah HipersomniaTernyata Madu Atasi Insomnia8 Bahan Alami Detox Segala Penyakit, Rebusan Ciplukan ObatnyaPersonal financial planning is made out to be complicated by some that get paid to do it for you. Levels Of Personal Finance. Although some financial planning aspects are best handled by experts there [2] an analysis of the importance of personal finance topics and the level of knowledge possessed by working adults.

Part of a series on financial services.

Personal finance 101, personal finance basics, and fundamentals.

Personal finance is the science of handling money.

It involves all financial decisions and.

The process of managing one's personal finances can be summarized in a budget or financial plan.

Budgeting is a beginner's skill to achieving our personal finance goals.

Budgeting is a necessary tool that helps us plan where we want our money to be spent, and allows us to i call this your level of commitment.

Personal finance ratios help the personal financial planning process.

Financial ratios can tell the truth about a particular financial situation.

This ratio can help you to know how fast you can convert your assets into cash.

Personal finance is all about managing your personal budget and how best to invest your money to realize your goals.

Smart personal finance involves developing strategies that include budgeting, creating an emergency fund, paying off debt, using credit cards wisely, saving for retirement, and more.

Personal finance refers to managing the financial activities like investment, budgeting, saving, risk allocation, mortgages and includes personal banking, planning for a future goals or desires and any such activities to enable those goals encompasses personal finance.

Learning how to budget, balance a cheque book, secure funds for important purchases, saving for.

But there are three levels of financial independence:

Budget fi, baseline fi, and blockbuster fi.

But what does financial independence really mean?

In this post i'd like to determine the three levels of financial independence.

Tracking your personal financial success is an important means of reaching your financial goals.

New benchmarks, trending metrics content, and tips and tricks to help you level up your analytics.

At the very basic level of personal finance, you should understand the need for, and value of, a budget.

A budget or spending plan is a road map for telling your money what to do each month.

Finance managers lead a team of other finance professionals to whom they delegate a wide range of tasks — from making revenue forecasts and tracking expenses to processing, recording, and verifying transactions.

Finance managers regularly create and present financial reports to various stakeholders.

Define personal finances and financial planning.

Start studying personal finance chapter 1.

Learn vocabulary, terms and more with flashcards, games and other study tools.

Personal finance doesn't have to be difficult.

Personal finance can be overwhelming when you start digging into it, so we'll focus on the basic concepts you should know.

While it's not all going to be a.

Personal finance experts love to debate the minutia of brown bag lunches and lattes but the most there are countless personal finance books out there.

The consistent management and improvement of your personal finances will see its impact not over.

These simple personal finance basics are ones every beginner should learn.

These will set you up for the future and remove money stress.

The final level of personal finance is the protection and management of your wealth.

Whatever your dreams for retirement (and why wait until you are 65) , understanding the different levels of personal finance and spending the time and resources to educate yourself will pay off whether you live next to.

There are perfectly worthwhile personal finance courses that don't cost a dime.

Also possible if you hold the cii advanced diploma in financial planning, have at least five years' industry experience and are a member of the cii or the personal finance society (pfs).

Figuring out how to manage your personal finances can seem like a daunting task.

It's tempting to simply not think about it, or to put off dealing with your money until the thing is, the sooner you learn how to make smart, strategic personal finance decisions, the easier it will be to live the life you want.

It will all add up to a meaningful sum. so, put your money to work for you now.

How to be smart with money.

Sometimes the most challenging part of personal finance is the personal part.

Personal finance is important because it's considering a variety of activities related to your finances and how to best manage them.

When we are younger, we tend to ignore the fact that we may need to have a sufficient level of money in the future.

Being young, we assign different priorities in our lives.

Alaska, california, montana, new mexico and wyoming, according to.

Personal finance brought to you with support from better money habits® powered by bank of america® bank of america, n.a.

Are not fdic insured, are not bank guaranteed, may lose value.

Personal financial planning is made out to be complicated by some that get paid to do it for you.

Although some financial planning aspects are best handled by experts there [2] an analysis of the importance of personal finance topics and the level of knowledge possessed by working adults.

Personal financial planning is made out to be complicated by some that get paid to do it for you. Levels Of Personal Finance. Although some financial planning aspects are best handled by experts there [2] an analysis of the importance of personal finance topics and the level of knowledge possessed by working adults.Resep Kreasi Potato Wedges Anti Gagal5 Kuliner Nasi Khas Indonesia Yang Enak Di LidahTernyata Fakta Membuktikan Kopi Indonesia Terbaik Di DuniaTernyata Makanan Ini Berasal Dari Dewa BumiResep Cumi Goreng Tepung Mantul9 Jenis-Jenis Kurma TerfavoritIkan Tongkol Bikin Gatal? Ini PenjelasannyaSejarah Gudeg JogyakartaResep Racik Bumbu Marinasi Ikan7 Makanan Pembangkit Libido

Comments

Post a Comment