Levels Of Personal Finance Budgeting Is A Beginner's Skill To Achieving Our Personal Finance Goals.

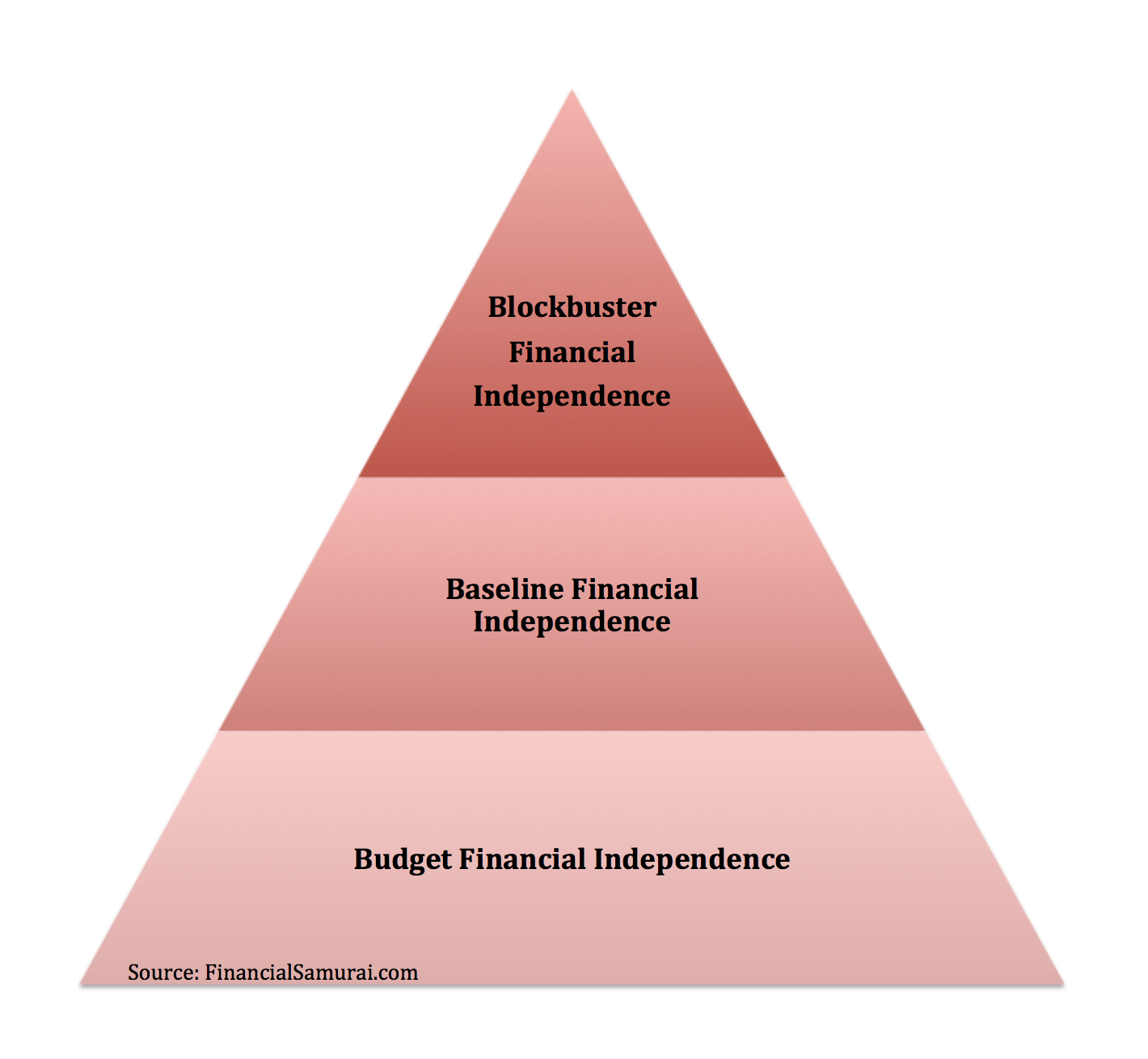

Levels Of Personal Finance. But There Are Three Levels Of Financial Independence:

SELAMAT MEMBACA!

Part of a series on financial services.

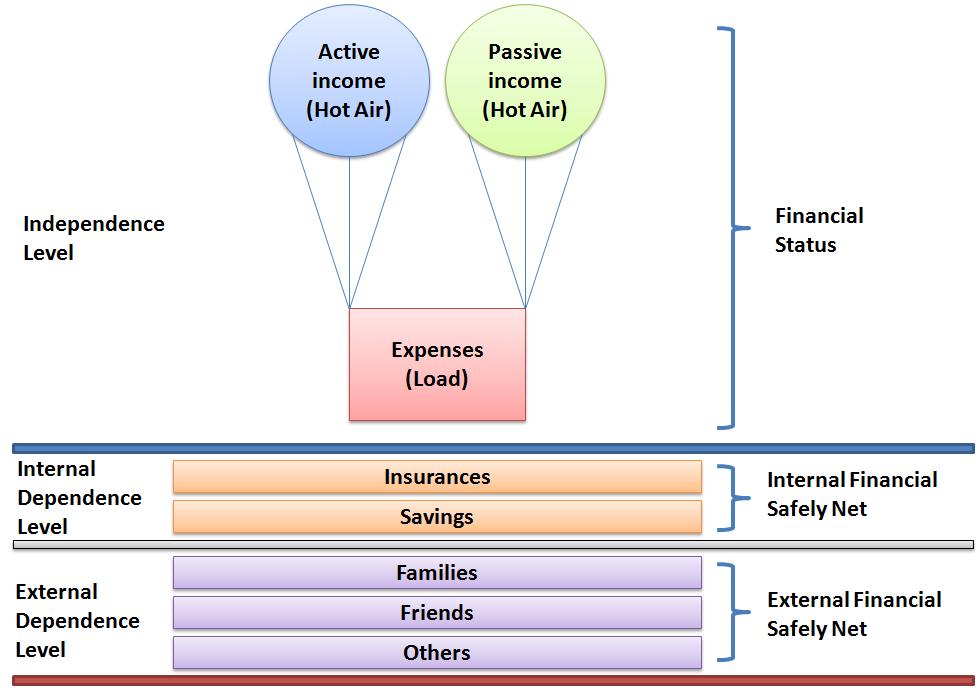

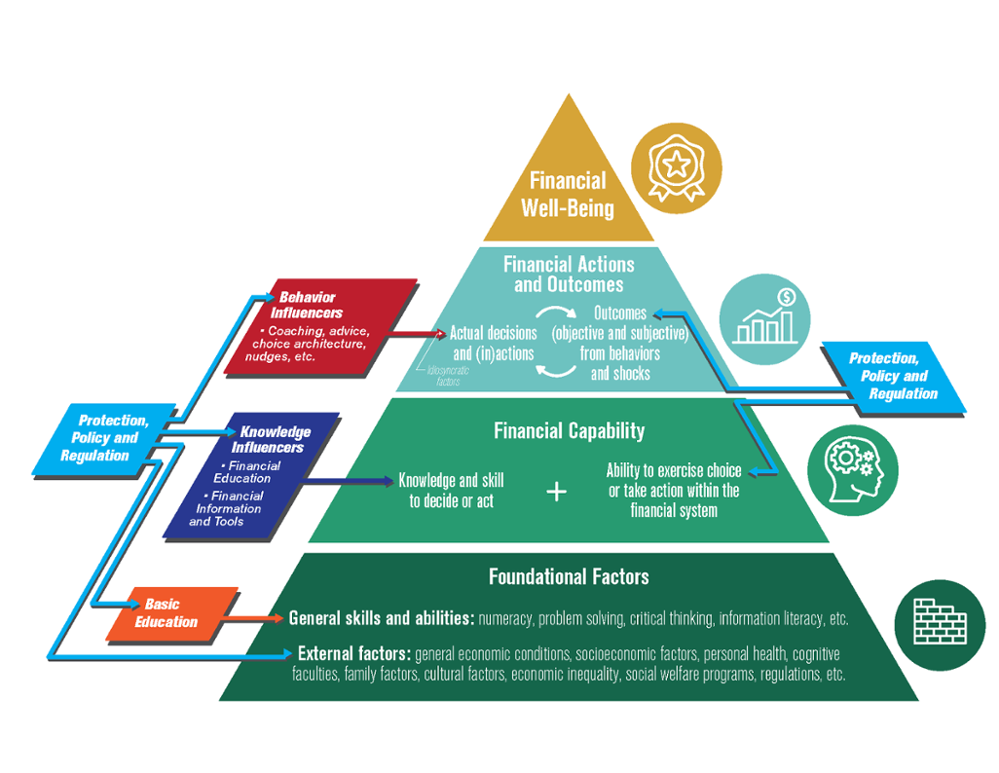

Personal finance is the process of planning and managing personal financial activities such as income generation, spending, saving, investing, and protection.

The process of managing one's personal finances can be summarized in a budget or financial plan.

Personal finance ratios help the personal financial planning process.

This ratio can help you to know how fast you can convert your assets into cash.

It is important to maintain at least a 15% level of liquidity to be able to combat.

You can master personal finance.

Budgeting is a beginner's skill to achieving our personal finance goals.

Budgeting is a necessary tool that helps us plan where we want our money to be spent, and allows us to evaluate our what's your level of commitment to accomplish what you set out to do (fill in the blank with your financial goals)?

This type of personal finance is one of the most commonly used and easy to identify.

Budget fi, baseline fi, and blockbuster fi.

Reaching financial independence is the holy grail of personal finance.

But what does financial independence really mean?

Accounting & finance personal statement.

Since studying business at gcse level and economics at as level, i have developed an interest in the role of finance within businesses.

Logic of quantity, strucutre and shape arrangement is all key routes that help to develop the art of financial knowledge.

Personal finance means taking care of your finances effectively.

It involves managing your money, how much you have invested in the share market and all personal finance is a term defining money management in the form of savings and investments.

It is an umbrella term comprising of investing.

Personal finance terms about insurance.

An insurance premium is the amount of money paid to an insurance company for the financial 33.

Having stock in a company grants you some level of ownership of the company.

At the very basic level of personal finance, you should understand the need for, and value of, a budget.

A budget or spending plan is a road map for telling your money what to do each month.

At its simplest, a budget lists how much income you have coming in compared to what's going out each.

Learn vocabulary, terms and more with flashcards, games and other study tools.

Khan academy's personal finance classes.

Ramsey solutions' financial peace university.

These will set you up for the future and remove money stress.

While not explicitly a part of personal finance, buying a home and understanding mortgages will impact your finances and making mistakes can put you in.

There are perfectly worthwhile personal finance courses that don't cost a dime.

Personal finance brought to you with support from better money habits® powered by bank of america® bank of america, n.a.

Are not fdic insured, are not bank guaranteed, may lose value.

Personal finance is important because it's considering a variety of activities related to your finances and how to best manage them.

Being young, we assign different priorities in our lives.

Define personal finances and financial planning.

Explain the financial planning life cycle.

Depending on the plan level you select, you'll be able to project budget.

N the earlier editions of the guide to personal finance, we explained the principles of making sound banking, credit, and mortgage decisions, as well as the basics of investing, financial planning, and taxes.

Our goal was to be comprehensive without being exhaustive, informative without being.

Obviously, financial management is a critical function in organizations.

Successful leadership and management of others requires successful leadership and management of oneself.

When seeking financial freedom, personal finance plays a significant role.

This will help propel you to a bright financial future.

If you wish to accomplish financially, you must manage your.

Free personal finance programs should be practical.

Also possible if you hold the cii advanced diploma in financial planning, have at least five years' industry experience and are a member of the cii or the personal finance society (pfs).

Personal financial planning is made out to be complicated by some that get paid to do it for you.

Ternyata Menikmati Alam Bebas Ada ManfaatnyaObat Hebat, Si Sisik NagaVitalitas Pria, Cukup Bawang Putih SajaSaatnya Minum Teh Daun Mint!!Ternyata Ini Beda Basil Dan Kemangi!!Multi Guna Air Kelapa HijauMelawan Pikun Dengan Apel8 Bahan Alami Detox 5 Rahasia Tetap Fit Saat Puasa Ala KiatSehatkuHindari Makanan Dan Minuman Ini Kala Perut KosongAlthough some financial planning aspects are best handled by experts there [2] an analysis of the importance of personal finance topics and the level of knowledge possessed by working adults. Levels Of Personal Finance. Financial literacy played an important role for everyone in managing personal finances.this research aimed to determine how the level of financial literacy in students s1 faculty of economics and business, universitas pasundan and investigate what factors are influencing it.

Part of a series on financial services.

/30386607081_620e3d475e_k-27d2c3542c9e4419a8697b09082b15d0.jpg)

Personal finance is the process of planning and managing personal financial activities such as income generation, spending, saving, investing, and protection.

The process of managing one's personal finances can be summarized in a budget or financial plan.

Personal finance ratios help the personal financial planning process.

This ratio can help you to know how fast you can convert your assets into cash.

It is important to maintain at least a 15% level of liquidity to be able to combat.

You can master personal finance.

Budgeting is a beginner's skill to achieving our personal finance goals.

Budgeting is a necessary tool that helps us plan where we want our money to be spent, and allows us to evaluate our what's your level of commitment to accomplish what you set out to do (fill in the blank with your financial goals)?

This type of personal finance is one of the most commonly used and easy to identify.

Budget fi, baseline fi, and blockbuster fi.

Reaching financial independence is the holy grail of personal finance.

But what does financial independence really mean?

Accounting & finance personal statement.

Since studying business at gcse level and economics at as level, i have developed an interest in the role of finance within businesses.

Logic of quantity, strucutre and shape arrangement is all key routes that help to develop the art of financial knowledge.

Personal finance means taking care of your finances effectively.

It involves managing your money, how much you have invested in the share market and all personal finance is a term defining money management in the form of savings and investments.

It is an umbrella term comprising of investing.

Personal finance terms about insurance.

An insurance premium is the amount of money paid to an insurance company for the financial 33.

Having stock in a company grants you some level of ownership of the company.

At the very basic level of personal finance, you should understand the need for, and value of, a budget.

A budget or spending plan is a road map for telling your money what to do each month.

At its simplest, a budget lists how much income you have coming in compared to what's going out each.

Learn vocabulary, terms and more with flashcards, games and other study tools.

Khan academy's personal finance classes.

Ramsey solutions' financial peace university.

These will set you up for the future and remove money stress.

While not explicitly a part of personal finance, buying a home and understanding mortgages will impact your finances and making mistakes can put you in.

There are perfectly worthwhile personal finance courses that don't cost a dime.

Personal finance brought to you with support from better money habits® powered by bank of america® bank of america, n.a.

Are not fdic insured, are not bank guaranteed, may lose value.

Personal finance is important because it's considering a variety of activities related to your finances and how to best manage them.

Being young, we assign different priorities in our lives.

Define personal finances and financial planning.

Explain the financial planning life cycle.

Depending on the plan level you select, you'll be able to project budget.

N the earlier editions of the guide to personal finance, we explained the principles of making sound banking, credit, and mortgage decisions, as well as the basics of investing, financial planning, and taxes.

Our goal was to be comprehensive without being exhaustive, informative without being.

Obviously, financial management is a critical function in organizations.

Successful leadership and management of others requires successful leadership and management of oneself.

When seeking financial freedom, personal finance plays a significant role.

This will help propel you to a bright financial future.

If you wish to accomplish financially, you must manage your.

Free personal finance programs should be practical.

Also possible if you hold the cii advanced diploma in financial planning, have at least five years' industry experience and are a member of the cii or the personal finance society (pfs).

Personal financial planning is made out to be complicated by some that get paid to do it for you.

Although some financial planning aspects are best handled by experts there [2] an analysis of the importance of personal finance topics and the level of knowledge possessed by working adults. Levels Of Personal Finance. Financial literacy played an important role for everyone in managing personal finances.this research aimed to determine how the level of financial literacy in students s1 faculty of economics and business, universitas pasundan and investigate what factors are influencing it.Stop Merendam Teh Celup Terlalu Lama!Ternyata Jajanan Pasar Ini Punya Arti RomantisNanas, Hoax Vs FaktaResep Beef Teriyaki Ala CeritaKulinerTips Memilih Beras BerkualitasResep Racik Bumbu Marinasi IkanResep Ramuan Kunyit Lada Hitam Libas Asam Urat & RadangResep Kreasi Potato Wedges Anti Gagal3 Jenis Daging Bahan Bakso TerbaikResep Cumi Goreng Tepung Mantul

Comments

Post a Comment