Levels Of Personal Finance Everything You Need To Know About Personal Finance In The U.s, Presented Through Concise, Engaging, Animated Videos.

Levels Of Personal Finance. Ramsey Solutions' Financial Peace University.

SELAMAT MEMBACA!

Part of a series on financial services.

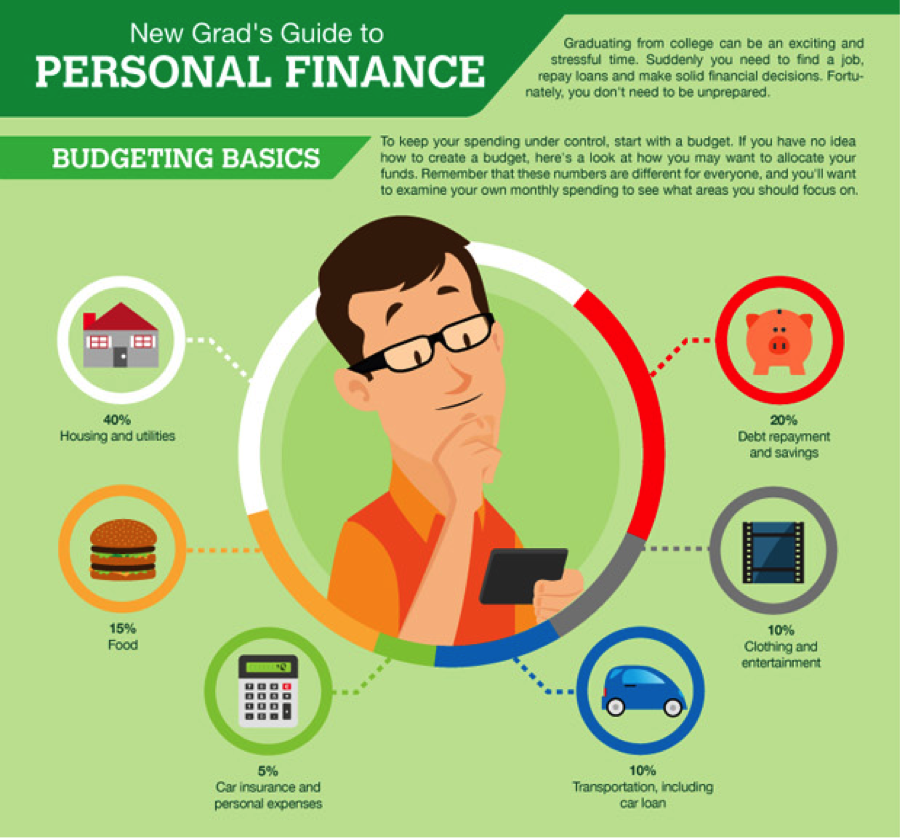

Budgeting is a beginner's skill to achieving our personal finance goals.

Budgeting is a necessary tool that helps us plan where we want our money to be spent, and allows us to i call this your level of commitment.

As you progress through the levels the tenacity becomes your throttle toward success.

The process of managing one's personal finances can be summarized in a budget or financial plan.

You can master personal finance.

Smart strategies for banking, budgeting, loans and credit, renting or buying, retirement, insurance, taxes, and more.

Financial ratios can tell the truth about a particular financial situation.

This ratio can help you to know how fast you can convert your assets into cash.

It is important to maintain at least a 15% level of liquidity to be able to combat.

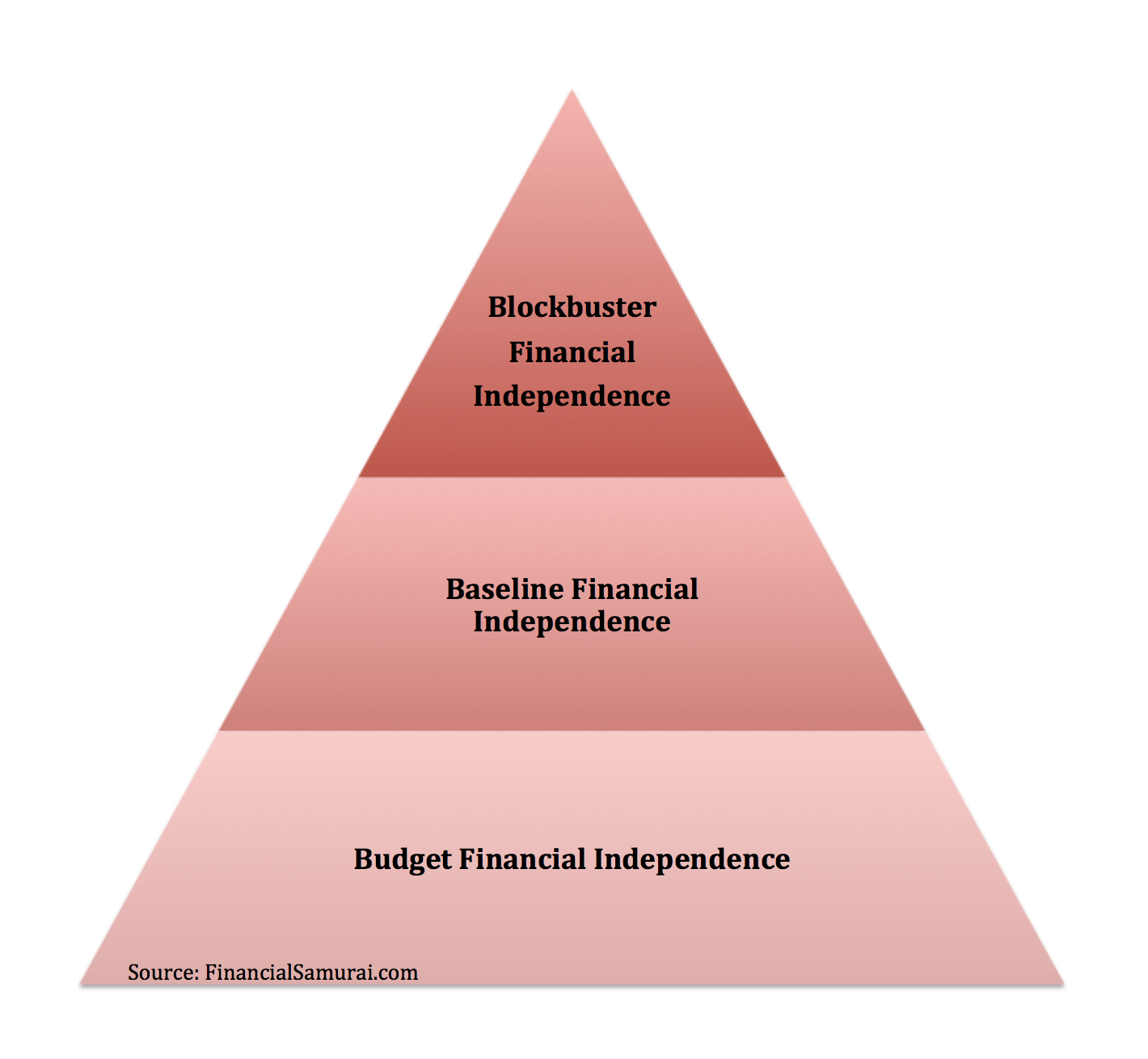

Budget fi, baseline fi, and blockbuster fi.

Reaching financial independence is the holy grail of personal finance.

But what does financial independence really mean?

At the very basic level of personal finance, you should understand the need for, and value of, a budget.

A budget or spending plan is a road map for creating a detailed and written budget allows you to make smarter decisions with your finances daily.

When you're faced with spending money on.

In fact, having the right personal finance skills is really important if you want to meet your financial goals in life.

And the sooner you start planning, the more beneficial it is for you.

So now that you're at the advanced level, you want to pay close attention to how you plan your debt repayment schedules.

Learn vocabulary, terms and more with flashcards, games and other study tools.

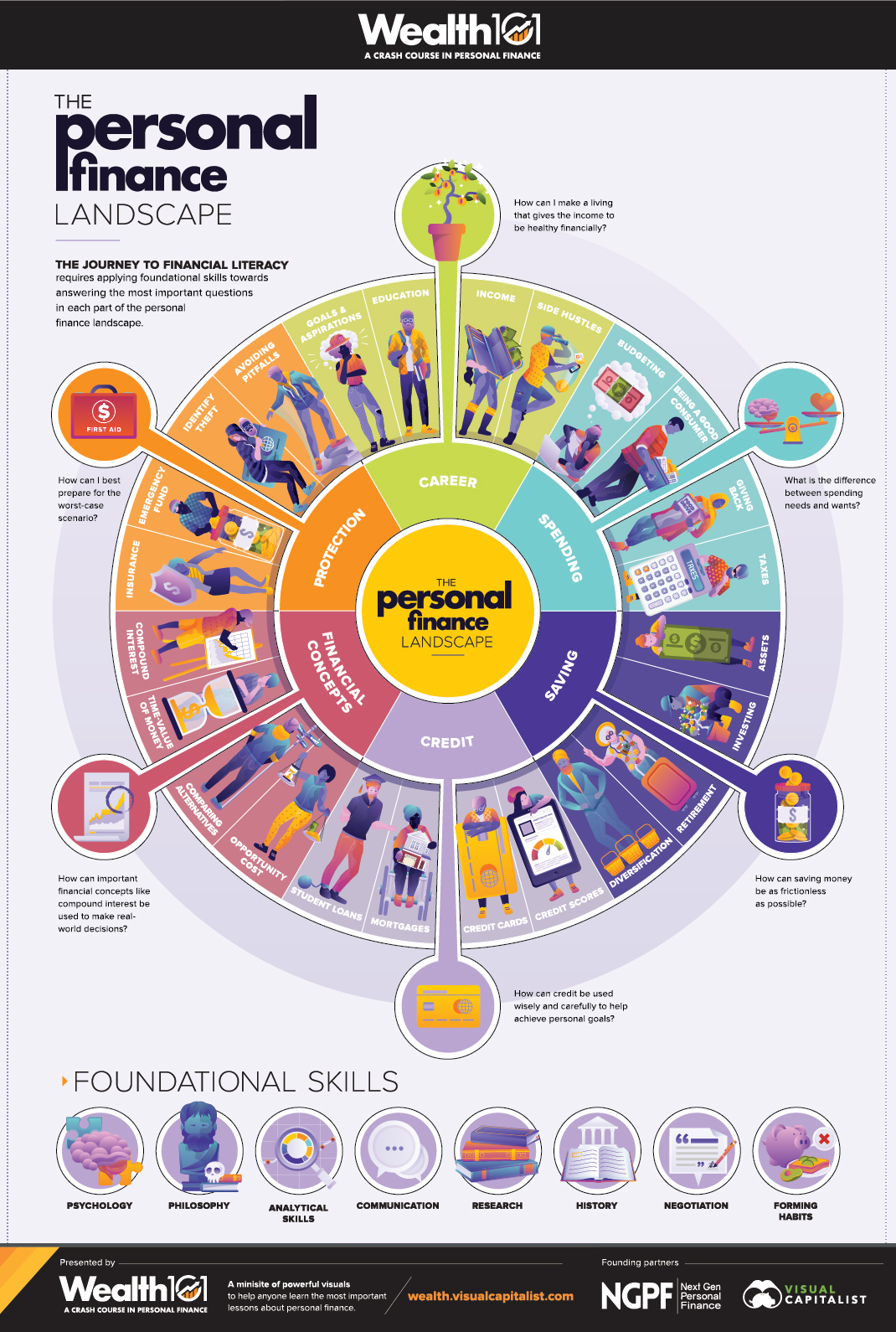

Hello, personal finance is the application of the principles of finance to the monetary decisions of an individual or family unit.

Personal finance all boils down to how you earn, spend, save, and invest your money.

These simple personal finance basics are ones every beginner should learn.

These will set you up for the future and remove money stress.

While not explicitly a part of personal finance, buying a home and understanding mortgages will impact your finances and making mistakes can put you in.

Personal finance is important because it's considering a variety of activities related to your finances and how to best manage them.

When we are younger, we tend to ignore the fact that we may need to have a sufficient level of money in the future.

Being young, we assign different priorities in our lives.

Khan academy's personal finance classes.

Ramsey solutions' financial peace university.

Personal finance brought to you with support from better money habits® powered by bank of america® bank of america, n.a.

A lot of personal finance and budget software providers offer something similar.

Depending on the plan level you select, you'll be able to project budget.

Personal financial planning is made out to be complicated by some that get paid to do it for you.

/30386607081_620e3d475e_k-27d2c3542c9e4419a8697b09082b15d0.jpg)

Here are 30 essential personal finance tips to help you learn how to be smart with money.

Some of us just get plain stressed whenever we think about the importance of personal finance.

Others can't think of anything worse than budgeting.

Explain the financial planning life cycle.

More states are adding personal finance courses as high school requirements, but the gains come against a student loan crisis and income gap in five states have no personal finance standard or requirement in public school:

Alaska, california, montana, new mexico and wyoming, according to.

Debt levels are at an all time high in the uk.

The younger generation tend to be feeling the pinch the most, but parents are increasingly being required to bail them out, often at great expense to their own limited mortgage or.

The seven levels range from foundation level to the level 7 chartered wealth manager qualification.

Everything you need to know about personal finance in the u.s, presented through concise, engaging, animated videos.

This course is designed for anyone looking to gain an excellent, practical knowledge of personal finance, covering everything from to taxes to credit cards.

This is the ultimate list of personal finance tips for young adults.

Struggling to get your personal finances in order?

A gobankingrates survey found that 62% of americans have less than $1,000 in their savings account.

Personal finance insider's mission is to help smart people make the best decisions with their money.

Business insider combed through the fine print of the research included personal loans at all different credit levels.

This is a cheap form of finance and it is readily available.

Tips Jitu Deteksi Madu Palsu (Bagian 2)Vitalitas Pria, Cukup Bawang Putih SajaIni Manfaat Seledri Bagi KesehatanTernyata Cewek Curhat Artinya SayangMulai Sekarang, Minum Kopi Tanpa Gula!!Ternyata Tertawa Itu DukaTernyata Tidur Terbaik Cukup 2 Menit!3 X Seminggu Makan Ikan, Penyakit Kronis MinggatTernyata Madu Atasi Insomnia5 Manfaat Posisi Viparita KaraniManaging your personal finances means that you will be able to successfully afford your current lifestyle as well as work towards your future financial goals. Levels Of Personal Finance. Sometimes this level of financial security can seem easier said than done.

At the very basic level of personal finance, you should understand the need for, and value of, a budget.

At its simplest, a budget lists how much income you have coming in compared to what's going out each.

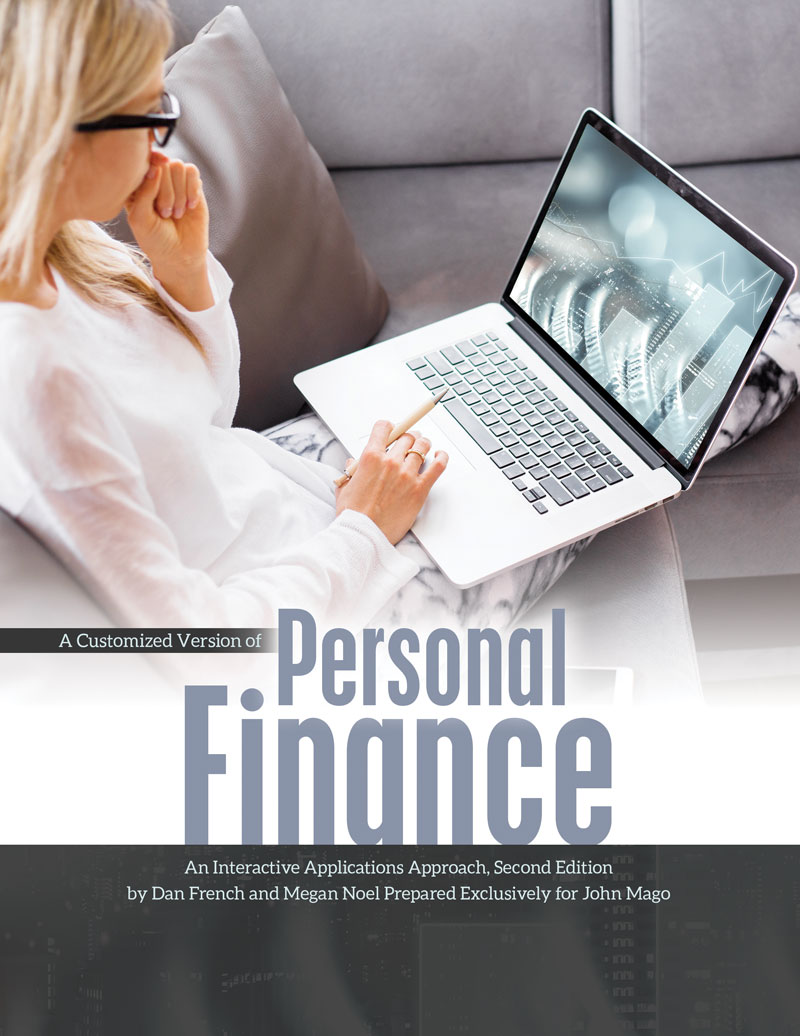

Personal finance is the process of planning and managing personal financial activities such as income generation, spending, saving, investing, and protection.

The process of managing one's personal finances can be summarized in a budget or financial plan.

Smart personal finance involves developing strategies that include budgeting, creating an emergency fund, paying off debt, using credit cards wisely, saving for retirement, and more.

But there are some basic finance concepts that absolutely can help.

I want you to never again feel that others can take advantage of you for what you don't know.

These simple personal finance basics are ones every beginner should learn.

These will set you up for the future and remove money stress.

If you need to budget throughout your financial journey, there is nothing wrong with doing so!

Start studying basic personal finance chapter 1.

Learn vocabulary, terms and more with flashcards, games and other study tools.

When the level of exports of us made products is lower than imported goods, this will typically cause the domestic money supply to:

Getting a hold of these basic concepts surprisingly enough doesn't come to many of us until later in life.

Although many of these things should be taught at the high school level.

Personal finance issues probably aren't among the first thoughts.

You can definitely break down personal finance concerns by age.

Things that are important when you're 22 become trivial at 55.

Understand main financial statements and the financial information they provide, write a financial transaction in financial accounting language and understand how this impacts main financial statements.

Financial problems of the household in allocating resources and net present value and the time value of money.

Basic principles of risk and return.

Optimal financing and asset administration;

Is quite an advanced personal finance software.

It's advanced because it makes it insanely easy to create simple budgets you could try manilla it's an online personal finance app, so works with mac or windows, and it has android and ios apps.

It's relatively simple compared to some other apps, too.

You can simplify the whole process using easy to use software.

Basic financial planning software simply provides an easy portal for managing your finances, but some of the more advanced ones can help with reducing.

The personal finance concentration will also be a valuable concentration for students who want to improve their knowledge in this area to enhance does not develop ideas lucidly, ineffective overall organization.

Seeking quality resources to teach personal finance basics?

Access the national financial educators council's if you lack an understanding of personal finance basics, you've discovered a goldmine of we help individuals and organizations improve personal finance basics and learn advanced.

Advanced diploma in accounting (level 3) this qualification can be used as a route to become an aat if you successfully complete the advanced diploma in accounting, you can apply for aat financial management is at the heart of every business, so demand for accounting and finance skills.

Yearlong course offered in suggested high school credit value:

10th grade level and up.

Upon successful completion of the advanced certificate in financial planning a student will be able to examine and comment on the changing nature of the financial planning environment in south africa in terms of structure and role players, regulation and consumer needs.

More states are adding personal finance courses as high school requirements, but the gains come against a student loan crisis and income gap in five states have no personal finance standard or requirement in public school:

Alaska, california, montana, new mexico and wyoming, according to.

Information for students and teachers of our btec nationals in personal and business finance (2010), including key documents here you'll find support for teaching and studying btec nationals in personal and business finance.

Corporate finance, personal finance and public finance.[1].

At the same time, and understanding the effects of tax policies, subsidies, or penalties on the management of personal finances while these are largely synonymous, the latter focuses on application, and the former focuses on modeling.

Entry level finance jobs are known for paying well and offering high bonuses for those who make it to the top.

Their work usually consists of client meetings and time spent.

A study of personal financial decisions that individuals must make in today's world.

An examination of the rationale for, and basic details of.

Finance against your home or any other property that you own is a simple and safe way to access much needed finance.

Al rajhi bank is pleased to announce the launch of the advanced personal finance, through sharia'a compliant commodities (as an alternative to shares), which will be available.

Full programme advanced 1 advanced 2.

Or minimum of 3 h2 level subjects with a pass or above.

Financial markets business finance macroeconomics 2 quantitative analysis investment basic econometrics price.

In singapore, financial planners are licensed and regulated by the monetary authority of singapore (mas) under the financial advisers act (faa).

The financial system provides channels to transfer funds from individual and groups who have saved money to individuals and group who want to borrow money.

Saver (refer to the lender) are suppliers of funds to borrowers in return with promises of repayment of even more funds in the future.

Basic financial education is not always that exciting to read.

I like to think of basic personal finance the same way i think about running a business.

You must apply to the student finance body in your country, as well as notify them of any changes to your circumstances, e.g.

You must apply to the student finance body in your country, as well as notify them of any changes to your circumstances, e.g. Levels Of Personal Finance. You leave or change your.Ternyata Inilah Makanan Indonesia Yang Tertulis Dalam PrasastiResep Ayam Suwir Pedas Ala CeritaKulinerSejarah Gudeg JogyakartaPetis, Awalnya Adalah Upeti Untuk RajaIni Beda Asinan Betawi & Asinan Bogor3 Jenis Daging Bahan Bakso TerbaikBir Pletok, Bir Halal BetawiSegarnya Carica, Buah Dataran Tinggi Penuh KhasiatAmpas Kopi Jangan Buang! Ini ManfaatnyaPecel Pitik, Kuliner Sakral Suku Using Banyuwangi

Comments

Post a Comment