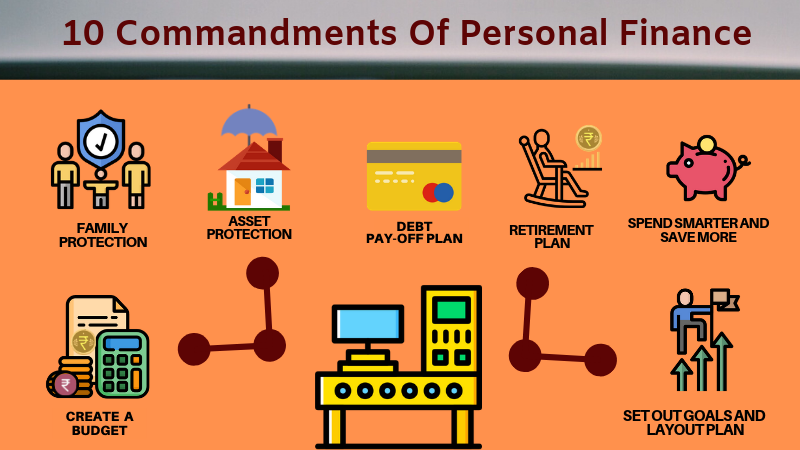

Levels Of Personal Finance At The Very Basic Level Of Personal Finance, You Should Understand The Need For, And Value Of, A Budget.

Levels Of Personal Finance. The Process Of Managing One's Personal Finances Can Be Summarized In A Budget Or Financial Plan.

SELAMAT MEMBACA!

Part of a series on financial services.

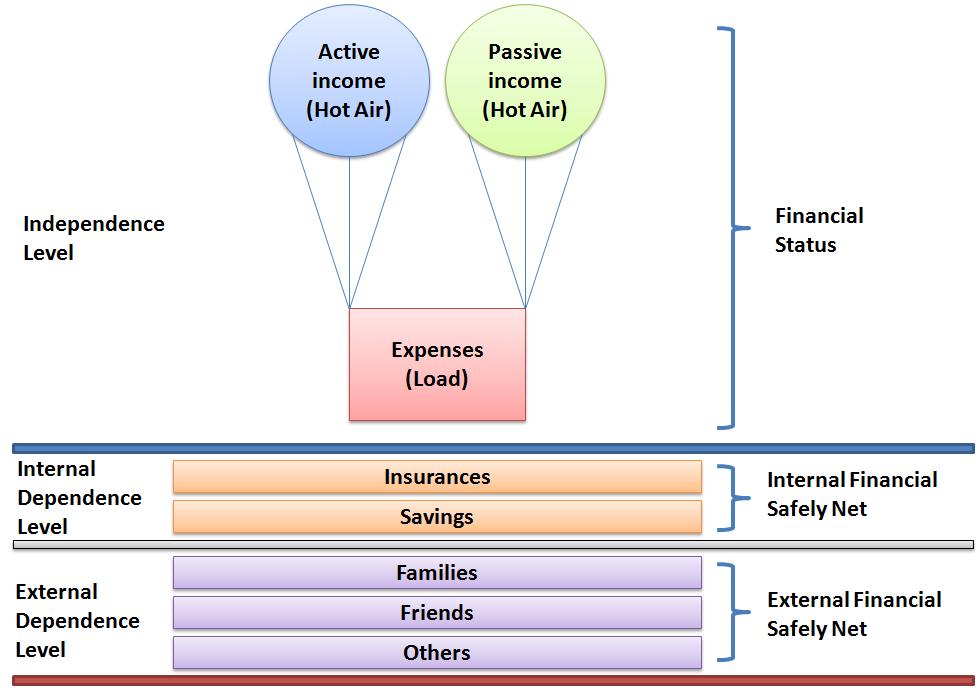

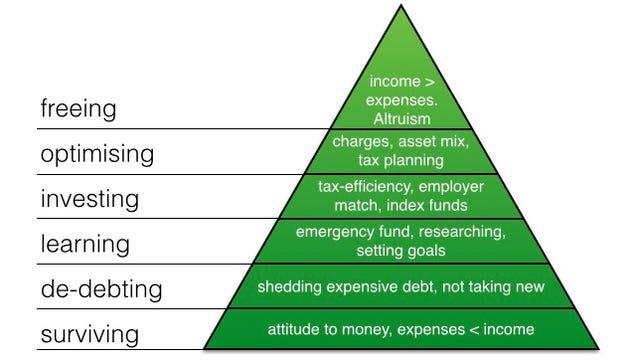

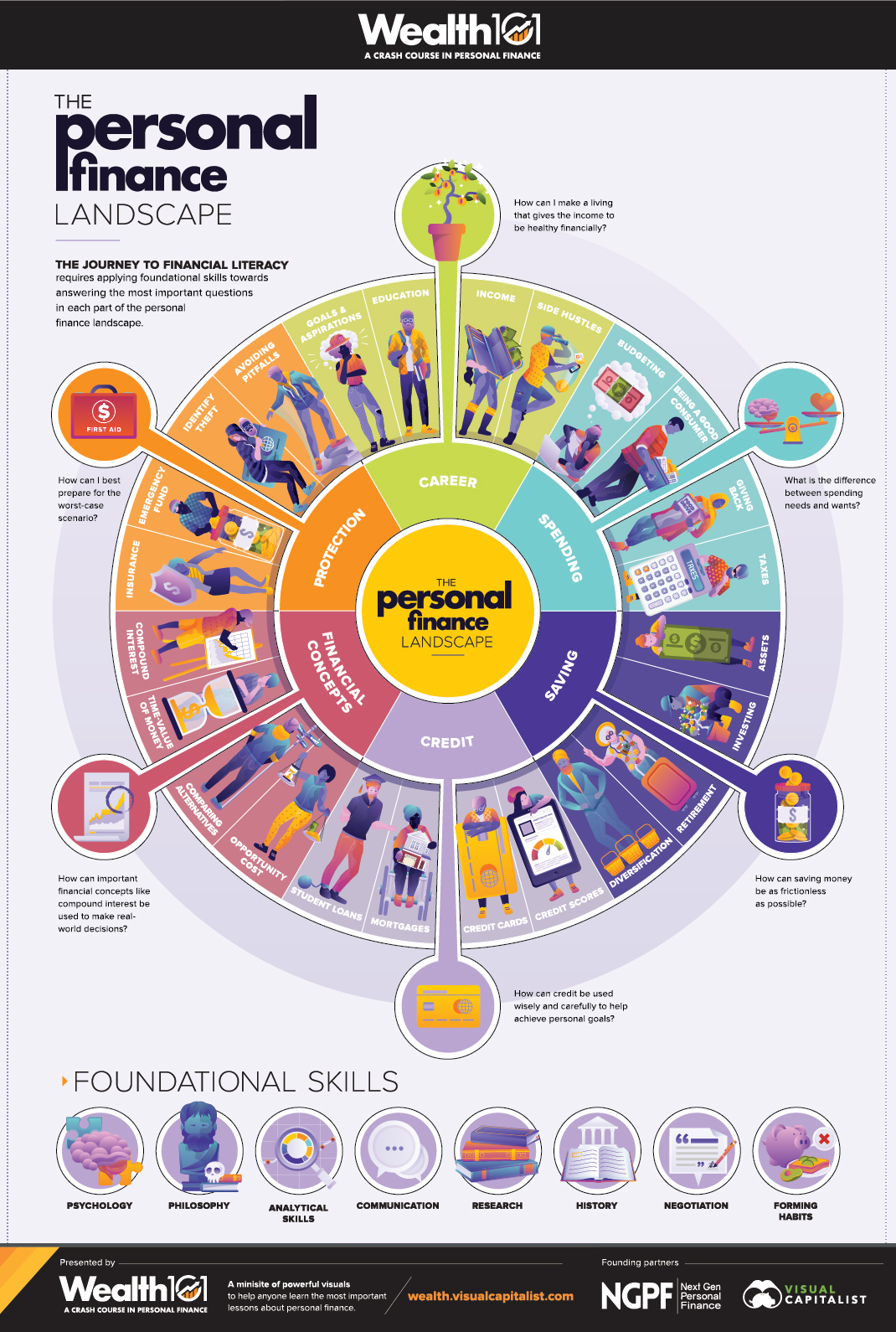

Personal finance is the process of planning and managing personal financial activities such as income generation, spending, saving, investing, and protection.

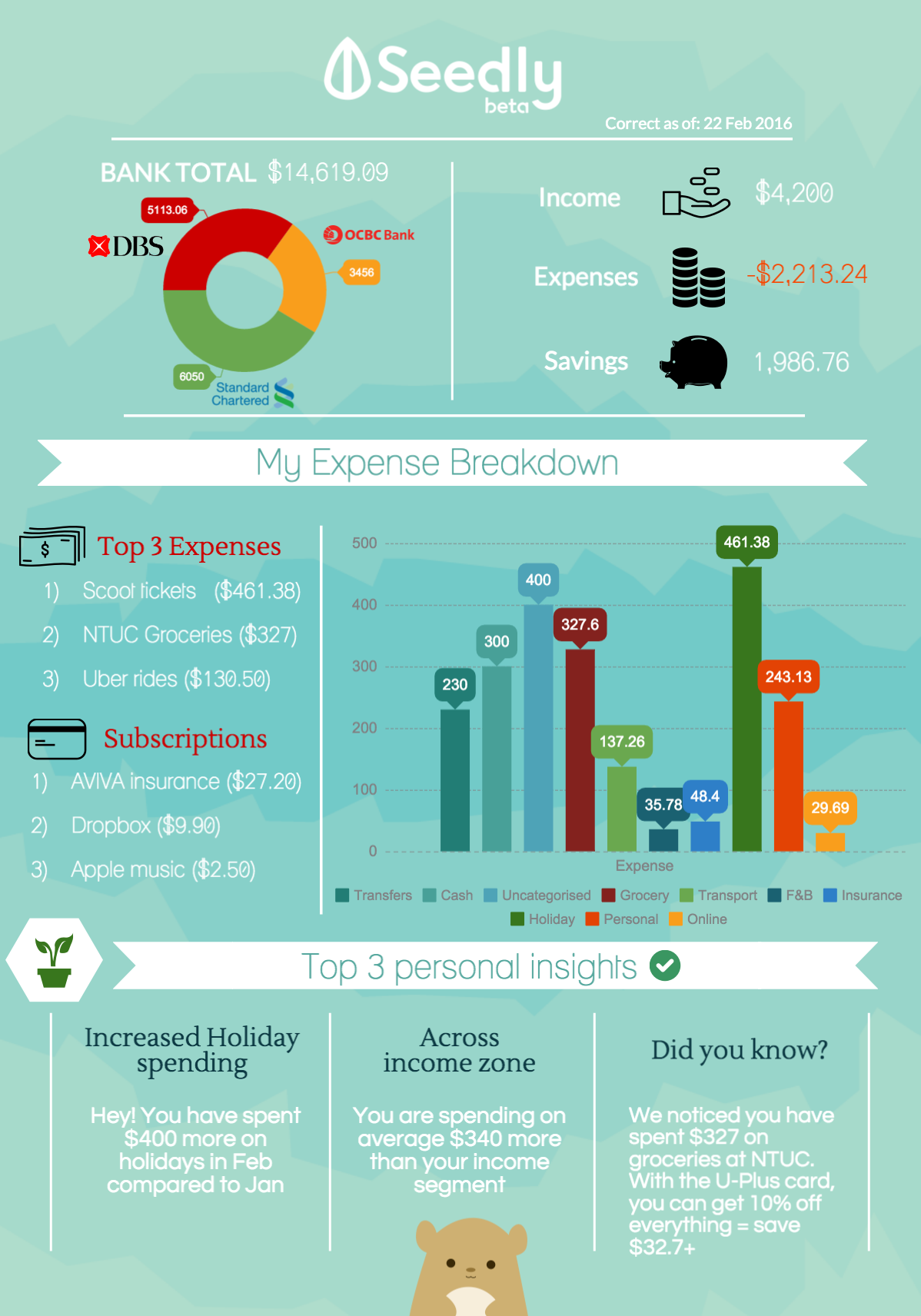

The process of managing one's personal finances can be summarized in a budget or financial plan.

Budgeting is a beginner's skill to achieving our personal finance goals.

As you progress through the levels the tenacity becomes your throttle toward success.

You can master personal finance.

Smart strategies for banking, budgeting, loans and credit, renting or buying, retirement, insurance, taxes, and more.

Financial ratios can tell the truth about a particular financial situation.

This ratio can help you to know how fast you can convert your assets into cash.

It is important to maintain at least a 15% level of liquidity to be able to combat.

By now if kayezad e.

Personal finance refers to managing the financial activities like investment, budgeting, saving, risk allocation, mortgages and includes personal banking, planning for a future goals or desires and any such activities to enable those goals encompasses personal finance.

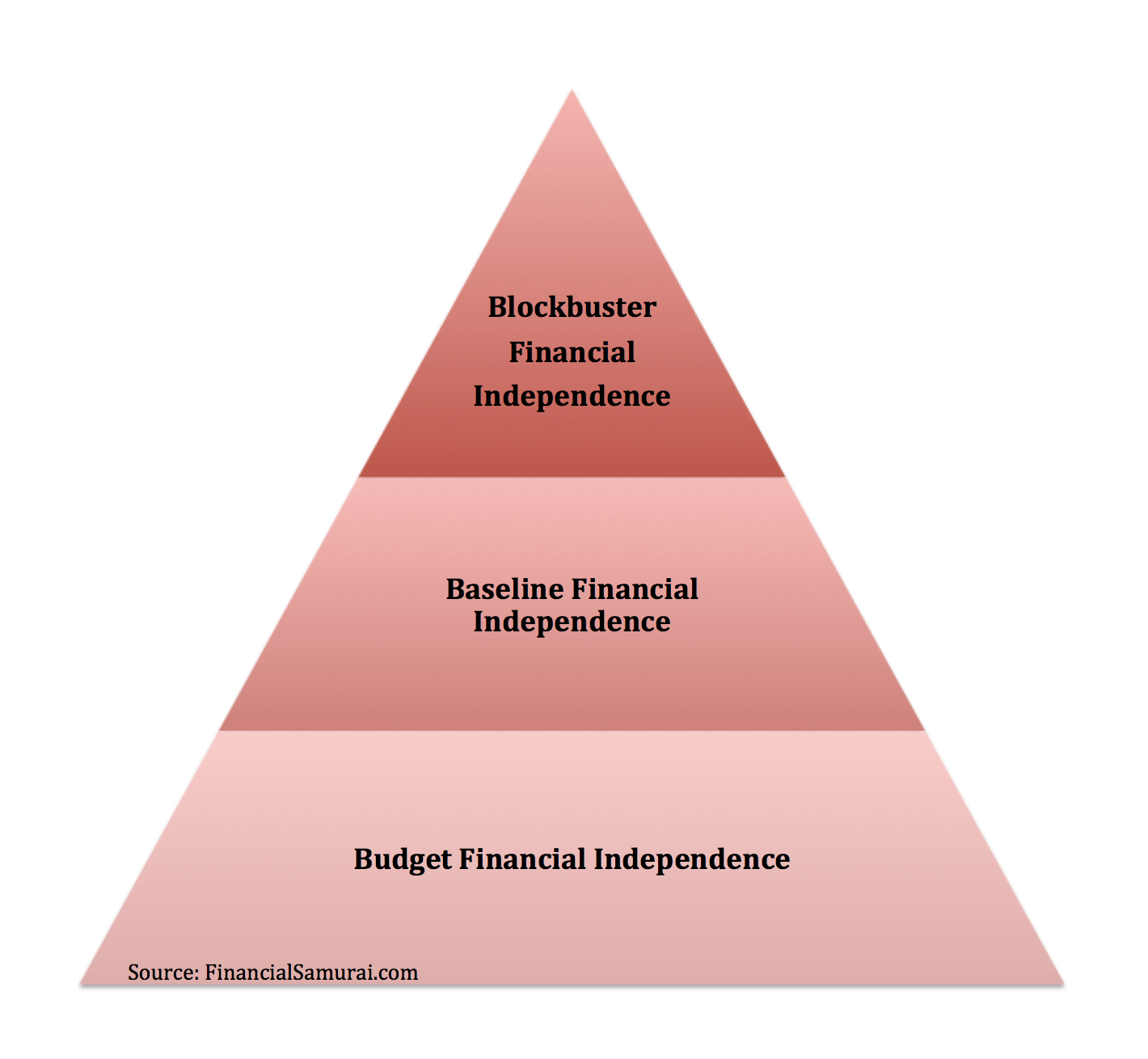

But there are three levels of financial independence:

Reaching financial independence is the holy grail of personal finance.

But what does financial independence really mean?

In this post i'd like to determine the three levels of financial independence.

Personal finance is a means of managing your finance effectively.

It involves the financial management of personal resources by budgeting, planning, saving and keeping stock for the future.

It could be at an individual or family level.

A budget or spending plan is a road map for telling your money what to do each month.

At its simplest, a budget lists how much income you have coming in compared to what's going out each.

Start studying personal finance chapter 1.

Define personal finances and financial planning.

Explain the financial planning life cycle.

Personal finance doesn't have to be difficult.

Personal finance can be overwhelming when you start digging into it, so we'll focus on the basic concepts you should know.

While it's not all going to be a.

Hello, personal finance is the application of the principles of finance to the monetary decisions of an individual or family unit.

In today's world, managing your money or your personal finance is of the utmost.

Personal finance terms about insurance.

An insurance premium is the amount of money paid to an insurance company for the financial 33.

When you buy shares, you become a.

Personal finance 101, personal finance basics, and fundamentals.

Personal finance is the science of handling money.

Free personal finance programs should be practical.

There are perfectly worthwhile personal finance courses that don't cost a dime.

These simple personal finance basics are ones every beginner should learn.

While not explicitly a part of personal finance, buying a home and understanding mortgages will impact your finances and making mistakes can put you in.

Personal finance is important because it's considering a variety of activities related to your finances and how to best manage them.

When we are younger, we tend to ignore the fact that we may need to have a sufficient level of money in the future.

Personal finance brought to you with support from better money habits® powered by bank of america® bank of america, n.a.

Are not fdic insured, are not bank guaranteed, may lose value.

Finance, especially personal finance, is easy to learn but very difficult to master.

The basic concept of saving or want to take this up a notch?

Buy a whiteboard and position it at eye level at your house.

This way you'll look at it multiple times a day and the chances of.

It will all add up to a meaningful sum. so, put your money to work for you now.

How to be smart with money.

Sometimes the most challenging part of personal finance is the personal part.

Alaska, california, montana, new mexico and wyoming, according to.

The seven levels range from foundation level to the level 7 chartered wealth manager qualification.

Also possible if you hold the cii advanced diploma in financial planning, have at least five years' industry experience and are a member of the cii or the personal finance society (pfs).

Although some financial planning aspects are best handled by experts there [2] an analysis of the importance of personal finance topics and the level of knowledge possessed by working adults.

Debt levels are at an all time high in the uk.

The younger generation tend to be feeling the pinch the most, but parents are increasingly being required to bail them out it has become almost accepted as a fact of life that graduates will begin their careers with a considerable level of personal debt.

This course is designed for anyone looking to gain an excellent, practical knowledge of personal finance, covering everything from to taxes to credit cards.

Mengusir Komedo Membandel - Bagian 25 Rahasia Tetap Fit Saat Puasa Ala KiatSehatkuSehat Sekejap Dengan Es BatuTernyata Menikmati Alam Bebas Ada ManfaatnyaObat Hebat, Si Sisik NagaAsi Lancar Berkat Pepaya MudaCara Benar Memasak SayuranTernyata Einstein Sering Lupa Kunci Motor5 Olahan Jahe Bikin SehatMelawan Pikun Dengan ApelEverything you need to know about personal finance in the u.s, presented through concise, engaging, animated videos. Levels Of Personal Finance. This course is designed for anyone looking to gain an excellent, practical knowledge of personal finance, covering everything from to taxes to credit cards.

Part of a series on financial services.

Personal finance is the process of planning and managing personal financial activities such as income generation, spending, saving, investing, and protection.

The process of managing one's personal finances can be summarized in a budget or financial plan.

Budgeting is a beginner's skill to achieving our personal finance goals.

As you progress through the levels the tenacity becomes your throttle toward success.

You can master personal finance.

Smart strategies for banking, budgeting, loans and credit, renting or buying, retirement, insurance, taxes, and more.

Financial ratios can tell the truth about a particular financial situation.

This ratio can help you to know how fast you can convert your assets into cash.

It is important to maintain at least a 15% level of liquidity to be able to combat.

By now if kayezad e.

Personal finance refers to managing the financial activities like investment, budgeting, saving, risk allocation, mortgages and includes personal banking, planning for a future goals or desires and any such activities to enable those goals encompasses personal finance.

But there are three levels of financial independence:

Reaching financial independence is the holy grail of personal finance.

But what does financial independence really mean?

In this post i'd like to determine the three levels of financial independence.

Personal finance is a means of managing your finance effectively.

It involves the financial management of personal resources by budgeting, planning, saving and keeping stock for the future.

It could be at an individual or family level.

/30386607081_620e3d475e_k-27d2c3542c9e4419a8697b09082b15d0.jpg)

A budget or spending plan is a road map for telling your money what to do each month.

At its simplest, a budget lists how much income you have coming in compared to what's going out each.

Start studying personal finance chapter 1.

Define personal finances and financial planning.

Explain the financial planning life cycle.

Personal finance doesn't have to be difficult.

Personal finance can be overwhelming when you start digging into it, so we'll focus on the basic concepts you should know.

While it's not all going to be a.

Hello, personal finance is the application of the principles of finance to the monetary decisions of an individual or family unit.

In today's world, managing your money or your personal finance is of the utmost.

Personal finance terms about insurance.

An insurance premium is the amount of money paid to an insurance company for the financial 33.

When you buy shares, you become a.

Personal finance 101, personal finance basics, and fundamentals.

Personal finance is the science of handling money.

Free personal finance programs should be practical.

There are perfectly worthwhile personal finance courses that don't cost a dime.

These simple personal finance basics are ones every beginner should learn.

While not explicitly a part of personal finance, buying a home and understanding mortgages will impact your finances and making mistakes can put you in.

Personal finance is important because it's considering a variety of activities related to your finances and how to best manage them.

When we are younger, we tend to ignore the fact that we may need to have a sufficient level of money in the future.

Personal finance brought to you with support from better money habits® powered by bank of america® bank of america, n.a.

Are not fdic insured, are not bank guaranteed, may lose value.

Finance, especially personal finance, is easy to learn but very difficult to master.

The basic concept of saving or want to take this up a notch?

Buy a whiteboard and position it at eye level at your house.

This way you'll look at it multiple times a day and the chances of.

It will all add up to a meaningful sum. so, put your money to work for you now.

How to be smart with money.

Sometimes the most challenging part of personal finance is the personal part.

Alaska, california, montana, new mexico and wyoming, according to.

The seven levels range from foundation level to the level 7 chartered wealth manager qualification.

Also possible if you hold the cii advanced diploma in financial planning, have at least five years' industry experience and are a member of the cii or the personal finance society (pfs).

Although some financial planning aspects are best handled by experts there [2] an analysis of the importance of personal finance topics and the level of knowledge possessed by working adults.

Debt levels are at an all time high in the uk.

The younger generation tend to be feeling the pinch the most, but parents are increasingly being required to bail them out it has become almost accepted as a fact of life that graduates will begin their careers with a considerable level of personal debt.

This course is designed for anyone looking to gain an excellent, practical knowledge of personal finance, covering everything from to taxes to credit cards.

Everything you need to know about personal finance in the u.s, presented through concise, engaging, animated videos. Levels Of Personal Finance. This course is designed for anyone looking to gain an excellent, practical knowledge of personal finance, covering everything from to taxes to credit cards.Amit-Amit, Kecelakaan Di Dapur Jangan Sampai Terjadi!!Resep Ponzu, Cocolan Ala JepangBir Pletok, Bir Halal BetawiWaspada, Ini 5 Beda Daging Babi Dan Sapi!!Bakwan Jamur Tiram Gurih Dan NikmatNikmat Kulit Ayam, Bikin SengsaraPecel Pitik, Kuliner Sakral Suku Using BanyuwangiFoto Di Rumah Makan PadangTernyata Hujan-Hujan Paling Enak Minum RotiBlack Ivory Coffee, Kopi Kotoran Gajah Pesaing Kopi Luwak

Comments

Post a Comment