Levels Of Personal Finance Personal Financial Planning Is Made Out To Be Complicated By Some That Get Paid To Do It For You.

Levels Of Personal Finance. Struggling To Get Your Personal Finances In Order?

SELAMAT MEMBACA!

Part of a series on financial services.

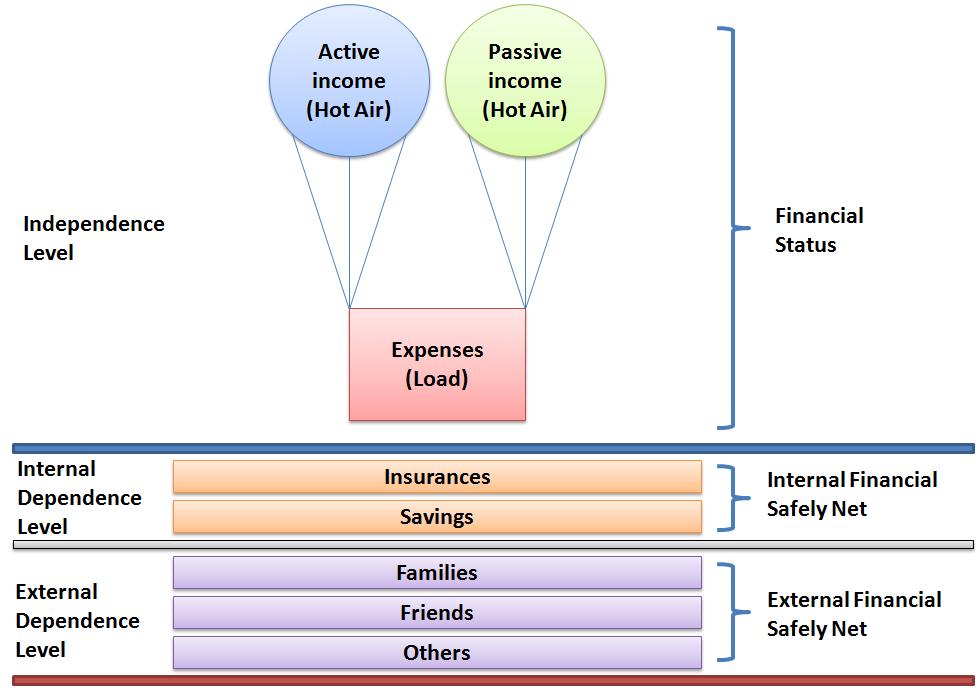

Budgeting is a beginner's skill to achieving our personal finance goals.

Budgeting is a necessary tool that helps us plan where we want our money to be spent, and allows us to i call this your level of commitment.

As you progress through the levels the tenacity becomes your throttle toward success.

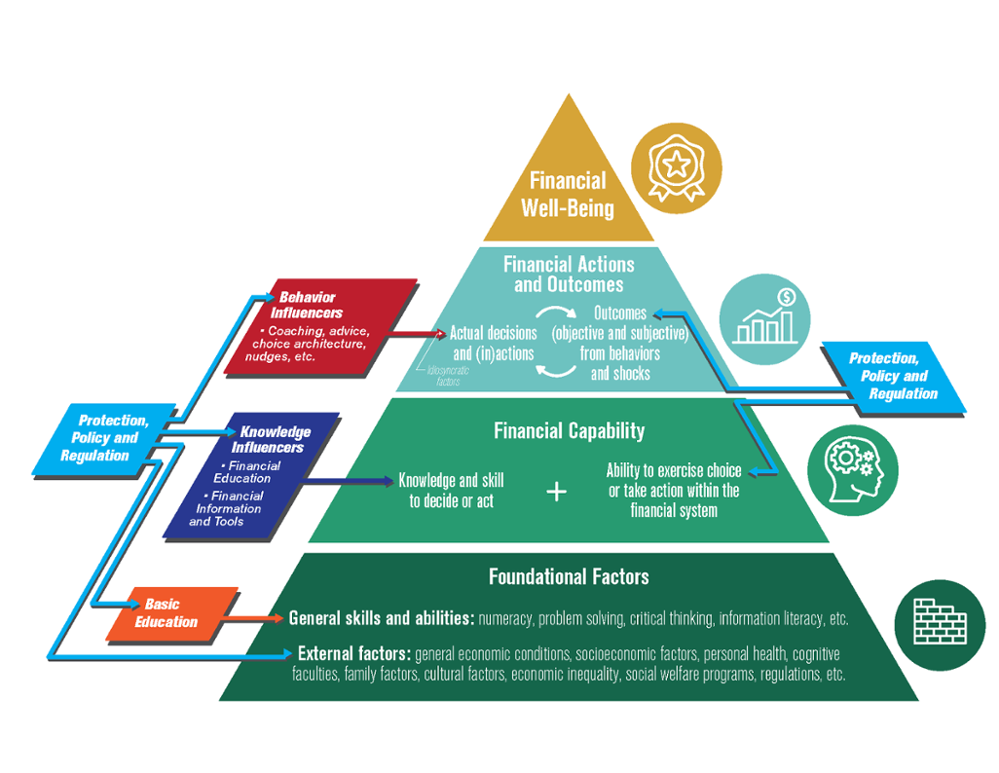

The process of managing one's personal finances can be summarized in a budget or financial plan.

You can master personal finance.

Smart strategies for banking, budgeting, loans and credit, renting or buying, retirement, insurance, taxes, and more.

Financial ratios can tell the truth about a particular financial situation.

This ratio can help you to know how fast you can convert your assets into cash.

It is important to maintain at least a 15% level of liquidity to be able to combat.

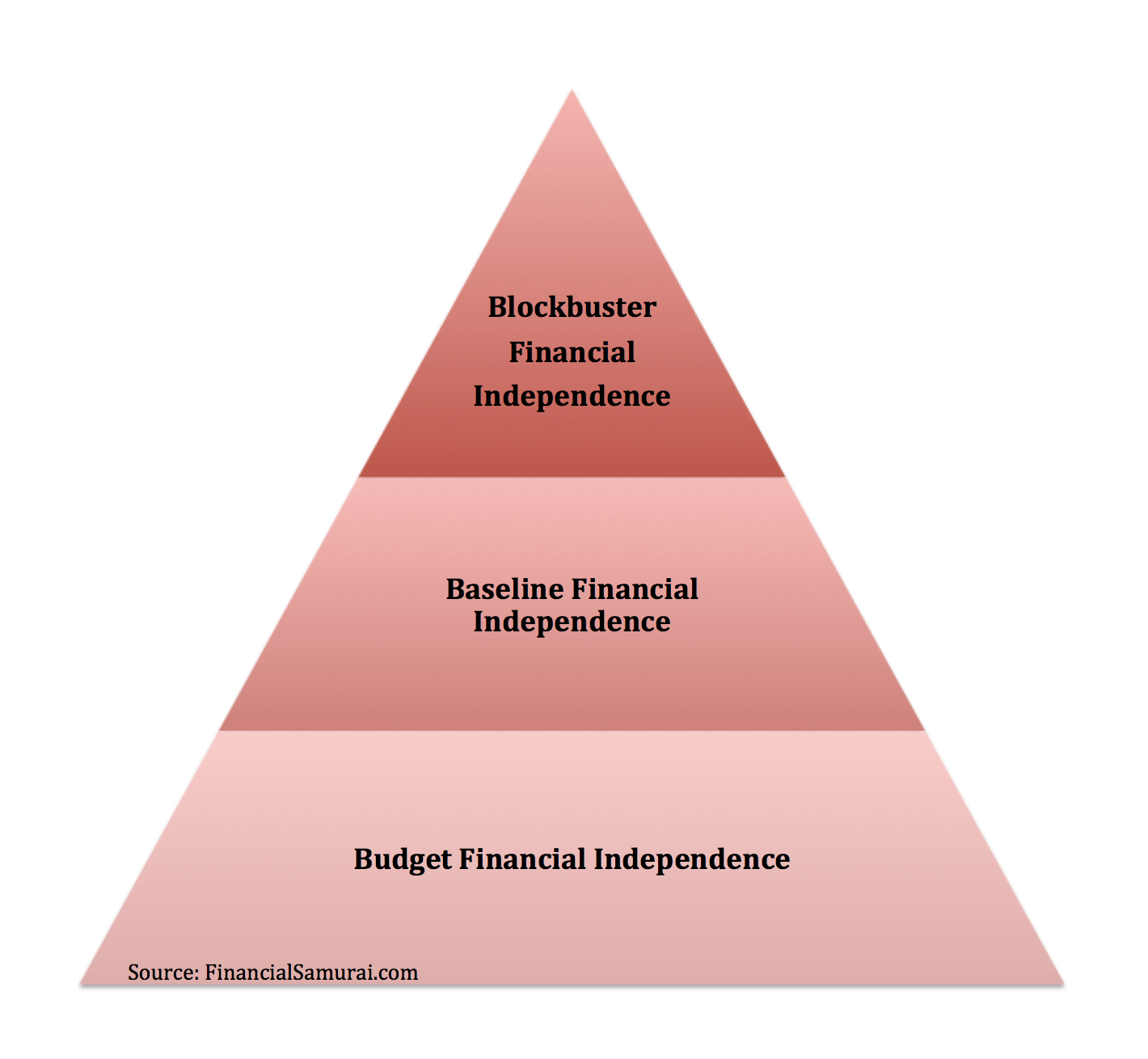

Budget fi, baseline fi, and blockbuster fi.

Reaching financial independence is the holy grail of personal finance.

But what does financial independence really mean?

At the very basic level of personal finance, you should understand the need for, and value of, a budget.

A budget or spending plan is a road map for creating a detailed and written budget allows you to make smarter decisions with your finances daily.

When you're faced with spending money on.

In fact, having the right personal finance skills is really important if you want to meet your financial goals in life.

And the sooner you start planning, the more beneficial it is for you.

So now that you're at the advanced level, you want to pay close attention to how you plan your debt repayment schedules.

Learn vocabulary, terms and more with flashcards, games and other study tools.

Hello, personal finance is the application of the principles of finance to the monetary decisions of an individual or family unit.

Personal finance all boils down to how you earn, spend, save, and invest your money.

These simple personal finance basics are ones every beginner should learn.

These will set you up for the future and remove money stress.

While not explicitly a part of personal finance, buying a home and understanding mortgages will impact your finances and making mistakes can put you in.

Personal finance is important because it's considering a variety of activities related to your finances and how to best manage them.

When we are younger, we tend to ignore the fact that we may need to have a sufficient level of money in the future.

Being young, we assign different priorities in our lives.

Khan academy's personal finance classes.

Ramsey solutions' financial peace university.

Personal finance brought to you with support from better money habits® powered by bank of america® bank of america, n.a.

A lot of personal finance and budget software providers offer something similar.

Depending on the plan level you select, you'll be able to project budget.

Personal financial planning is made out to be complicated by some that get paid to do it for you.

Here are 30 essential personal finance tips to help you learn how to be smart with money.

Some of us just get plain stressed whenever we think about the importance of personal finance.

Others can't think of anything worse than budgeting.

Explain the financial planning life cycle.

More states are adding personal finance courses as high school requirements, but the gains come against a student loan crisis and income gap in five states have no personal finance standard or requirement in public school:

Alaska, california, montana, new mexico and wyoming, according to.

Debt levels are at an all time high in the uk.

The younger generation tend to be feeling the pinch the most, but parents are increasingly being required to bail them out, often at great expense to their own limited mortgage or.

The seven levels range from foundation level to the level 7 chartered wealth manager qualification.

Everything you need to know about personal finance in the u.s, presented through concise, engaging, animated videos.

This course is designed for anyone looking to gain an excellent, practical knowledge of personal finance, covering everything from to taxes to credit cards.

This is the ultimate list of personal finance tips for young adults.

Struggling to get your personal finances in order?

A gobankingrates survey found that 62% of americans have less than $1,000 in their savings account.

Personal finance insider's mission is to help smart people make the best decisions with their money.

/30386607081_620e3d475e_k-27d2c3542c9e4419a8697b09082b15d0.jpg)

Business insider combed through the fine print of the research included personal loans at all different credit levels.

This is a cheap form of finance and it is readily available.

Melawan Pikun Dengan ApelTips Jitu Deteksi Madu Palsu (Bagian 1)Ternyata Mudah Kaget Tanda Gangguan MentalKhasiat Luar Biasa Bawang Putih PanggangMana Yang Lebih Sehat, Teh Hitam VS Teh Hijau?Saatnya Bersih-Bersih UsusGawat! Minum Air Dingin Picu Kanker!Resep Alami Lawan Demam AnakIni Efek Buruk Overdosis Minum KopiPentingnya Makan Setelah OlahragaManaging your personal finances means that you will be able to successfully afford your current lifestyle as well as work towards your future financial goals. Levels Of Personal Finance. Sometimes this level of financial security can seem easier said than done.

Part of a series on financial services.

Budgeting is a beginner's skill to achieving our personal finance goals.

Budgeting is a necessary tool that helps us plan where we want our money to be spent, and allows us to i call this your level of commitment.

As you progress through the levels the tenacity becomes your throttle toward success.

The process of managing one's personal finances can be summarized in a budget or financial plan.

You can master personal finance.

Smart strategies for banking, budgeting, loans and credit, renting or buying, retirement, insurance, taxes, and more.

Financial ratios can tell the truth about a particular financial situation.

This ratio can help you to know how fast you can convert your assets into cash.

It is important to maintain at least a 15% level of liquidity to be able to combat.

Budget fi, baseline fi, and blockbuster fi.

Reaching financial independence is the holy grail of personal finance.

But what does financial independence really mean?

At the very basic level of personal finance, you should understand the need for, and value of, a budget.

A budget or spending plan is a road map for creating a detailed and written budget allows you to make smarter decisions with your finances daily.

When you're faced with spending money on.

In fact, having the right personal finance skills is really important if you want to meet your financial goals in life.

And the sooner you start planning, the more beneficial it is for you.

So now that you're at the advanced level, you want to pay close attention to how you plan your debt repayment schedules.

Learn vocabulary, terms and more with flashcards, games and other study tools.

Hello, personal finance is the application of the principles of finance to the monetary decisions of an individual or family unit.

Personal finance all boils down to how you earn, spend, save, and invest your money.

These simple personal finance basics are ones every beginner should learn.

These will set you up for the future and remove money stress.

While not explicitly a part of personal finance, buying a home and understanding mortgages will impact your finances and making mistakes can put you in.

Personal finance is important because it's considering a variety of activities related to your finances and how to best manage them.

When we are younger, we tend to ignore the fact that we may need to have a sufficient level of money in the future.

Being young, we assign different priorities in our lives.

Khan academy's personal finance classes.

Ramsey solutions' financial peace university.

Personal finance brought to you with support from better money habits® powered by bank of america® bank of america, n.a.

A lot of personal finance and budget software providers offer something similar.

Depending on the plan level you select, you'll be able to project budget.

Personal financial planning is made out to be complicated by some that get paid to do it for you.

Here are 30 essential personal finance tips to help you learn how to be smart with money.

Some of us just get plain stressed whenever we think about the importance of personal finance.

Others can't think of anything worse than budgeting.

Explain the financial planning life cycle.

More states are adding personal finance courses as high school requirements, but the gains come against a student loan crisis and income gap in five states have no personal finance standard or requirement in public school:

Alaska, california, montana, new mexico and wyoming, according to.

Debt levels are at an all time high in the uk.

The younger generation tend to be feeling the pinch the most, but parents are increasingly being required to bail them out, often at great expense to their own limited mortgage or.

The seven levels range from foundation level to the level 7 chartered wealth manager qualification.

Everything you need to know about personal finance in the u.s, presented through concise, engaging, animated videos.

This course is designed for anyone looking to gain an excellent, practical knowledge of personal finance, covering everything from to taxes to credit cards.

This is the ultimate list of personal finance tips for young adults.

Struggling to get your personal finances in order?

A gobankingrates survey found that 62% of americans have less than $1,000 in their savings account.

Personal finance insider's mission is to help smart people make the best decisions with their money.

Business insider combed through the fine print of the research included personal loans at all different credit levels.

This is a cheap form of finance and it is readily available.

Managing your personal finances means that you will be able to successfully afford your current lifestyle as well as work towards your future financial goals. Levels Of Personal Finance. Sometimes this level of financial security can seem easier said than done.Cegah Alot, Ini Cara Benar Olah Cumi-CumiTernyata Inilah Makanan Indonesia Yang Tertulis Dalam PrasastiResep Garlic Bread Ala CeritaKuliner 7 Makanan Pembangkit LibidoBuat Sendiri Minuman Detoxmu!!3 Cara Pengawetan Cabai5 Cara Tepat Simpan TelurIkan Tongkol Bikin Gatal? Ini PenjelasannyaResep Beef Teriyaki Ala CeritaKuliner3 Jenis Daging Bahan Bakso Terbaik

Comments

Post a Comment