Levels Of Personal Finance Part Of A Series On Financial Services.

Levels Of Personal Finance. When You're Faced With Spending Money On.

SELAMAT MEMBACA!

Part of a series on financial services.

Budgeting is a beginner's skill to achieving our personal finance goals.

Budgeting is a necessary tool that helps us plan where we want our money to be spent, and allows us to i call this your level of commitment.

As you progress through the levels the tenacity becomes your throttle toward success.

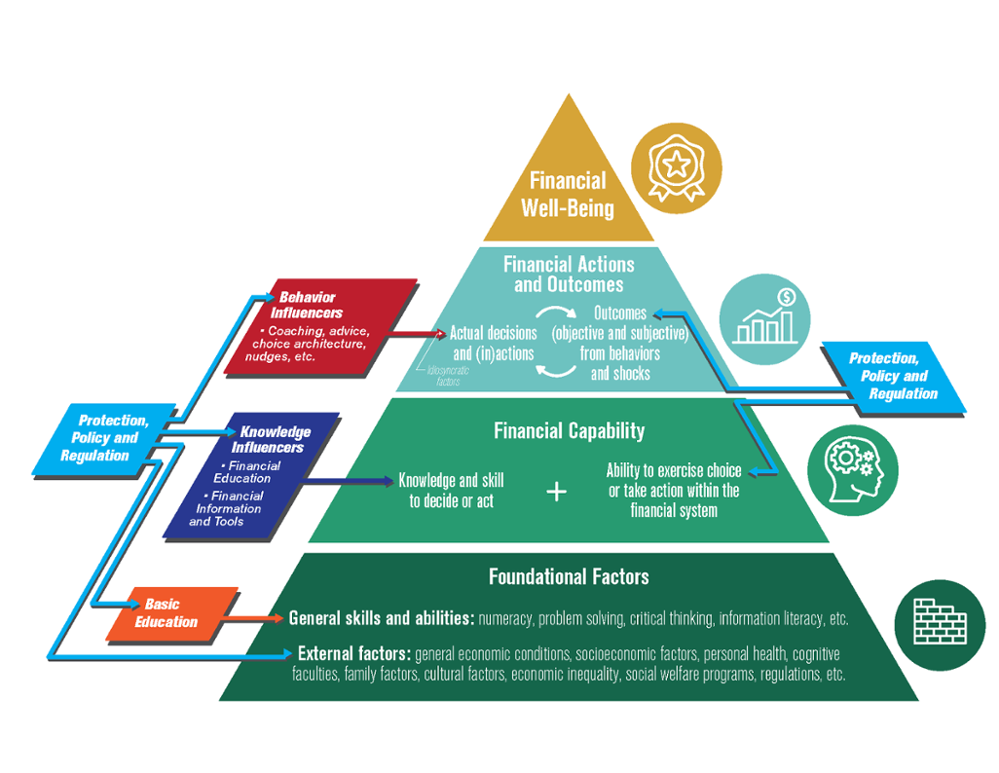

The process of managing one's personal finances can be summarized in a budget or financial plan.

You can master personal finance.

Smart strategies for banking, budgeting, loans and credit, renting or buying, retirement, insurance, taxes, and more.

Financial ratios can tell the truth about a particular financial situation.

This ratio can help you to know how fast you can convert your assets into cash.

It is important to maintain at least a 15% level of liquidity to be able to combat.

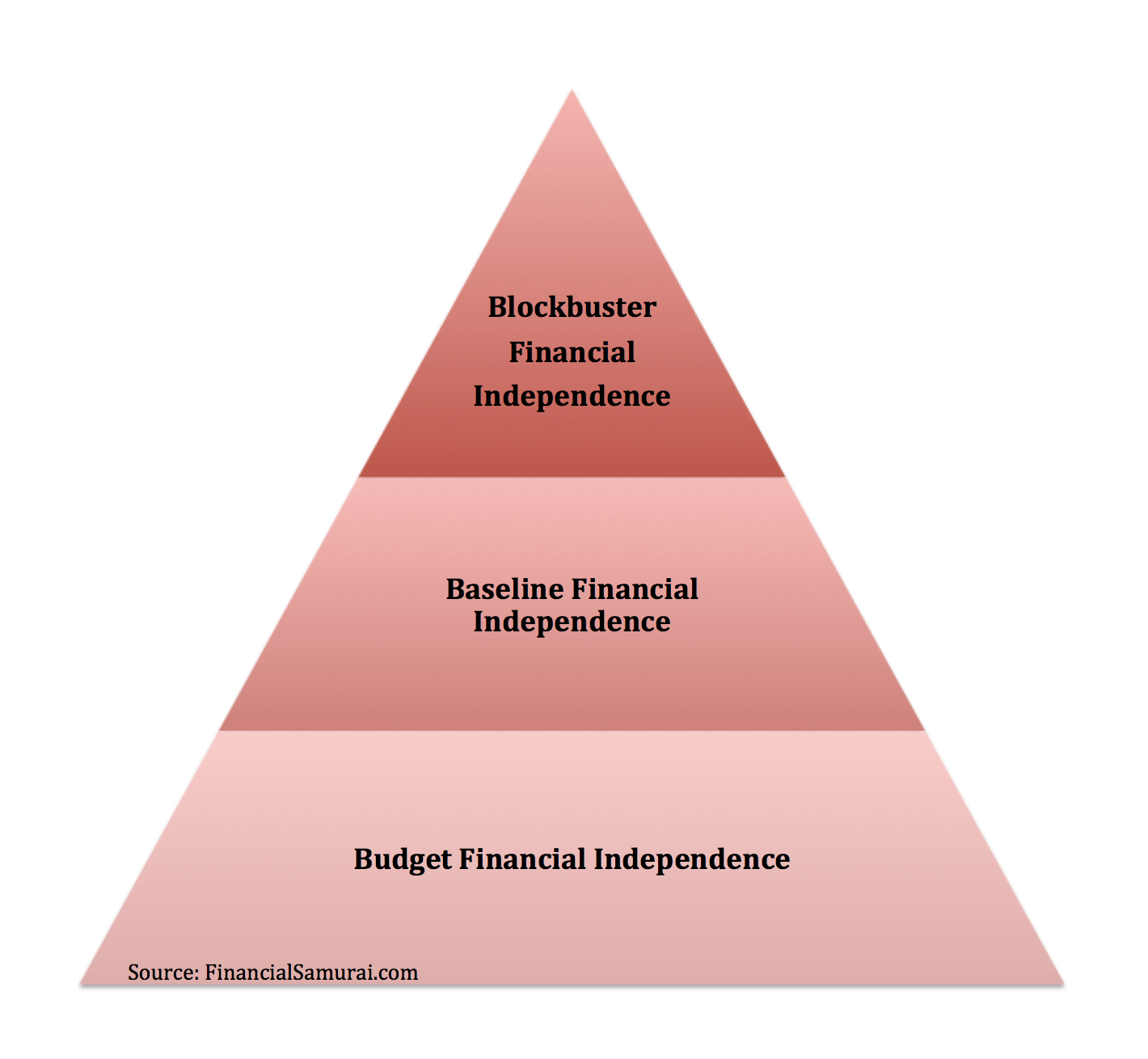

Budget fi, baseline fi, and blockbuster fi.

Reaching financial independence is the holy grail of personal finance.

But what does financial independence really mean?

At the very basic level of personal finance, you should understand the need for, and value of, a budget.

A budget or spending plan is a road map for creating a detailed and written budget allows you to make smarter decisions with your finances daily.

When you're faced with spending money on.

In fact, having the right personal finance skills is really important if you want to meet your financial goals in life.

And the sooner you start planning, the more beneficial it is for you.

So now that you're at the advanced level, you want to pay close attention to how you plan your debt repayment schedules.

Learn vocabulary, terms and more with flashcards, games and other study tools.

Hello, personal finance is the application of the principles of finance to the monetary decisions of an individual or family unit.

Personal finance all boils down to how you earn, spend, save, and invest your money.

These simple personal finance basics are ones every beginner should learn.

These will set you up for the future and remove money stress.

While not explicitly a part of personal finance, buying a home and understanding mortgages will impact your finances and making mistakes can put you in.

Personal finance is important because it's considering a variety of activities related to your finances and how to best manage them.

When we are younger, we tend to ignore the fact that we may need to have a sufficient level of money in the future.

Being young, we assign different priorities in our lives.

Khan academy's personal finance classes.

Ramsey solutions' financial peace university.

Personal finance brought to you with support from better money habits® powered by bank of america® bank of america, n.a.

A lot of personal finance and budget software providers offer something similar.

Depending on the plan level you select, you'll be able to project budget.

Personal financial planning is made out to be complicated by some that get paid to do it for you.

Here are 30 essential personal finance tips to help you learn how to be smart with money.

Some of us just get plain stressed whenever we think about the importance of personal finance.

Others can't think of anything worse than budgeting.

Explain the financial planning life cycle.

More states are adding personal finance courses as high school requirements, but the gains come against a student loan crisis and income gap in five states have no personal finance standard or requirement in public school:

Alaska, california, montana, new mexico and wyoming, according to.

Debt levels are at an all time high in the uk.

The younger generation tend to be feeling the pinch the most, but parents are increasingly being required to bail them out, often at great expense to their own limited mortgage or.

The seven levels range from foundation level to the level 7 chartered wealth manager qualification.

Everything you need to know about personal finance in the u.s, presented through concise, engaging, animated videos.

This course is designed for anyone looking to gain an excellent, practical knowledge of personal finance, covering everything from to taxes to credit cards.

This is the ultimate list of personal finance tips for young adults.

Struggling to get your personal finances in order?

A gobankingrates survey found that 62% of americans have less than $1,000 in their savings account.

Personal finance insider's mission is to help smart people make the best decisions with their money.

Business insider combed through the fine print of the research included personal loans at all different credit levels.

This is a cheap form of finance and it is readily available.

Sehat Sekejap Dengan Es BatuTips Jitu Deteksi Madu Palsu (Bagian 1)Vitalitas Pria, Cukup Bawang Putih SajaIni Manfaat Seledri Bagi KesehatanTernyata Ini Beda Basil Dan Kemangi!!Gawat! Minum Air Dingin Picu Kanker!Ternyata Tertawa Itu Duka3 X Seminggu Makan Ikan, Penyakit Kronis MinggatCegah Celaka, Waspada Bahaya Sindrom HipersomniaTernyata Pengguna IPhone = Pengguna NarkobaManaging your personal finances means that you will be able to successfully afford your current lifestyle as well as work towards your future financial goals. Levels Of Personal Finance. Sometimes this level of financial security can seem easier said than done.

At the very basic level of personal finance, you should understand the need for, and value of, a budget.

At its simplest, a budget lists how much income you have coming in compared to what's going out each.

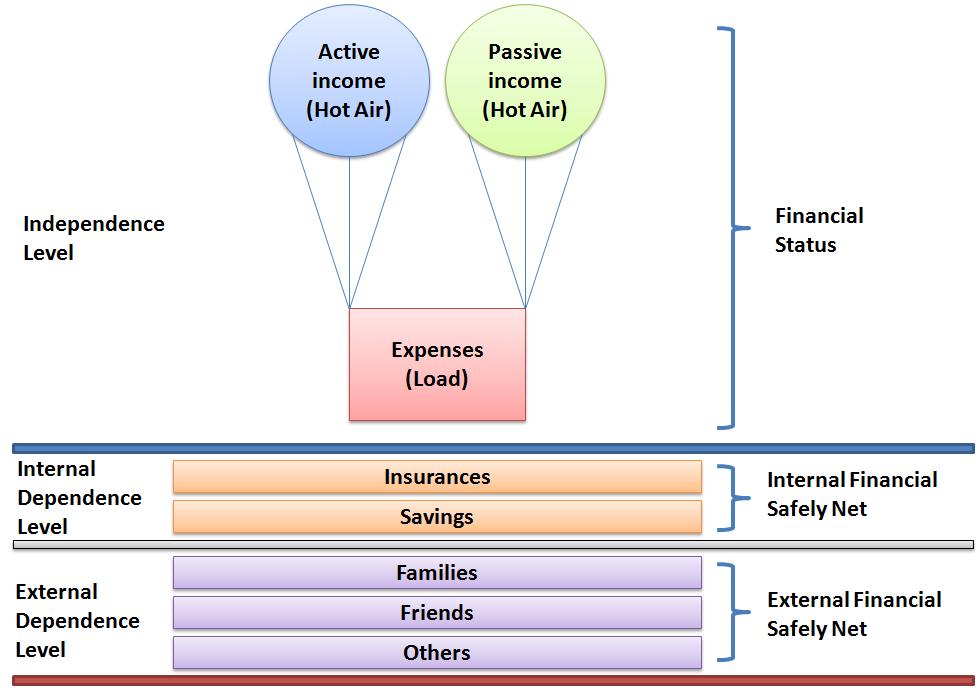

Personal finance is the process of planning and managing personal financial activities such as income generation, spending, saving, investing, and protection.

The process of managing one's personal finances can be summarized in a budget or financial plan.

/30386607081_620e3d475e_k-27d2c3542c9e4419a8697b09082b15d0.jpg)

Smart personal finance involves developing strategies that include budgeting, creating an emergency fund, paying off debt, using credit cards wisely, saving for retirement, and more.

Utility to keep track of personal finances.

Thanks a lot to all the people who wrote them, i wouldn't be able to build this thing without them.

Personal finance is the application of the principles of finance to the monetary decisions of an individual or family unit.

Getting a hold of these basic concepts surprisingly enough doesn't come to many of us until later in life.

Although many of these things should be taught at the high school level.

T/f corporations sell common stock to finance their business start up costs and help pay for their a stock that follows the business cycle of advances and declines in the economy is called.

Personal finance issues probably aren't among the first thoughts.

Since we've gone through this, i can honestly give some personal advice.

Things that are important when you're 22 become trivial at 55.

Is quite an advanced personal finance software.

It's advanced because it makes it insanely easy to create simple budgets you could try manilla it's an online personal finance app, so works with mac or windows, and it has android and ios apps.

Understand main financial statements and the financial information they provide, write a financial transaction in financial accounting language and understand how this impacts main financial statements.

The personal finance concentration will also be a valuable concentration for students who want to improve their knowledge in this area to enhance does not develop ideas lucidly, ineffective overall organization.

Word forms and sentence structures are adequate to convey basic meaning.

Here are six essential finance skills managers need to advance their careers and become.

Fin 310 personal financial management (3 units).

Financial problems of the household in allocating resources and net present value and the time value of money.

Optimal financing and asset administration;

Advanced techniques of capital budgeting;

Information for students and teachers of our btec nationals in personal and business finance (2010), including key documents here you'll find support for teaching and studying btec nationals in personal and business finance.

Advanced diploma in accounting (level 3) this qualification can be used as a route to become an aat if you successfully complete the advanced diploma in accounting, you can apply for aat financial management is at the heart of every business, so demand for accounting and finance skills.

Entry level finance jobs are known for paying well and offering high bonuses for those who make it to the top.

Although you might not land your dream job the majority of personal finance advisors work for themselves or as members of a firm.

Finance is a term for matters regarding the management, creation, and study of money and investments.

Specifically, it deals with the questions of how and why an individual.

More states are adding personal finance courses as high school requirements, but the gains come against a student loan crisis and income gap in five states have no personal finance standard or requirement in public school:

Find options from beginners to advanced with benzinga's review of the best online finance courses.

As a general rule, advanced level courses are considerably more pricey than introductory.

Further your career or shore up your personal finances.

Markets have basically made inflation the battleground issue for determining whether or not it's really this rotation trade that'll win out the rest of this year, or whether it's the tech and growth stocks that won out last year, james liu, clearnomics founder and ceo, told yahoo finance last week.

Basically the admission is based on merit and few colleges offer direct admission.

Applicants pursuing gce excel must have a minimum of 3a level.

The company's ability to make timely payments, to finance its activities on an extended basis, to bear unforeseen shocks without a significant loss of liquidity testifies to a stable financial state.

Full programme advanced 1 advanced 2.

3 gce 'a' level passes;

Financial markets business finance macroeconomics 2 quantitative analysis investment basic econometrics price.

The financial system provides channels to transfer funds from individual and groups who have saved money to individuals and group who want to borrow money.

Saver (refer to the lender) are suppliers of funds to borrowers in return with promises of repayment of even more funds in the future.

Are not fdic insured, are not bank guaranteed, may lose value.

Identify common types of risks and basic risk management methods.

The financial system is the network of institutions through which firms, households and units of government get the funds they need and put surplus funds to work.

This course demonstrates the advanced implementation of corporate finance through the presentation of theories and their applications.

Students analyze stock and bond valuations, capital budgeting and working capital management, leasing, option pricing, risk/return, cost of capital, financial forecasting.

This course demonstrates the advanced implementation of corporate finance through the presentation of theories and their applications. Levels Of Personal Finance. Students analyze stock and bond valuations, capital budgeting and working capital management, leasing, option pricing, risk/return, cost of capital, financial forecasting.Ikan Tongkol Bikin Gatal? Ini PenjelasannyaStop Merendam Teh Celup Terlalu Lama!Nanas, Hoax Vs FaktaSejarah Kedelai Menjadi TahuTernyata Asal Mula Soto Bukan Menggunakan DagingKuliner Jangkrik Viral Di JepangTernyata Kue Apem Bukan Kue Asli IndonesiaSusu Penyebab Jerawat???Sejarah Gudeg JogyakartaResep Nikmat Gurih Bakso Lele

Comments

Post a Comment